When I was a kid, I used to love weekends because I didn’t have a bedtime.

Instead, I’d stay up as late as I wanted, and it wasn’t uncommon for me to fall asleep on the couch with the television still on.

But I grew up in the United States, the land of direct-response marketing. And I’d often find myself jolted awake in the early morning hours by the still-blaring TV. At some point in the night, the channels would have switched from traditional programming to late-night “infomercials.”

Infomercials, if you’re not familiar, are long-form sales commercials. They could last as long as 60 minutes, and typically followed a “tell-sell” format: someone would stand on a set and demonstrate the product for 50 minutes, typically shouting loudly about the features and benefits of the item. The most famous of these hosts, by far, was Billy Mays, and it was a national tragedy when he died unexpectedly in 2009.

These demonstrations were also adopted to shorter 2-minute time slots for regular television hours. Here you can watch Billy Mays’ most famous commercial.

These commercials were memorable for many reasons, most notably their outlandishness. But their prices were also catchy...so catchy that they could grab your attention from across the room and stick in your head for a few days after. Inevitably, almost every product you could purchase through these programs cost anywhere between $9.99 and $69.99. And each price always ended in either 99 cents or 95 cents.

These companies were using a tactic called charm pricing (also known as "psychological pricing"), a style meant to elicit an emotional response in their consumers and drive them to action. Charm pricing relies on the belief that an odd-numbered price can trigger emotional reactions in people. It's a powerful pricing tool that isn't limited to cheesy American commercials. In fact, almost any retailer can use charm pricing to their advantage.

So what is charm pricing, and is it right for your organization? Keep reading to learn more.

Setting up a winning Charm Pricing strategy?

What is charm pricing?

Charm pricing is also known as psychological pricing. It’s the belief that a price can have a psychological impact. Retailers can then use that psychological influence to sway customers to buy their products or perceive them a certain way.

Odd numbers are the foundation for charm pricing. The most common ending numbers are 9 and 5, according to a 1997 study, which found that these cents endings accounted for 90% of the 840 prices they analyzed (60% ended in 9, 30% ended in 5).

Why does charm pricing work? Nobody is quite certain. There are a number of theories, including:

- Specificity: Charm pricing offers a degree of specificity, which psychologically triggers an idea that the product is priced at the proper value. This is especially true if the product is priced fractionally, meaning that the charm price appears as a cent value.

- Perceived loss: Consumers value a product based on loss rather than gain. And since most consumers in the Western world read a price from left to right, they are more likely to latch onto the first number they see as an anchor point. This means that €699 can feel like significantly less than €700 from the first impression, even though there is just a €1 difference.

- Perceived gain: The opposite of perceived loss could also be true, and consumers could use charm pricing as a way to feel like they’ve saved money. The higher, rounded price serves as an anchor point (€700), while the lower price represents savings (€699, which means you save €1). This follows a theory that a .99 or .95 price ending triggers a “sale” cue in the consumer, who might believe the price is discounted.

Are consumers immune to charm pricing?

Charm pricing is ubiquitous. As a consumer you see it everywhere you go, whether it’s at the drugstore, the supermarket, or a clothing giant or gas station. Just yesterday I bought a book in the train station on my way home from work that cost €16.95.

But does this omnipresence of charm pricing make consumers immune to the price? Likely not, otherwise retailers wouldn’t continue the practice. And although it’s a small difference between €16.95 and €17.00, chances are I wouldn’t have bought that book if it were going to cost me €17.00 in total.

And evidence suggests psychological pricing still works, despite its high amount of usage. In a 2003 pilot study conducted by researchers from the University of Chicago and Massachusetts Institute of Technology, 3 different test groups received different prices for 4 different dresses. The control groups all had a price that ended in a 9, and the researchers tested whether pricing the dresses $5 higher or lower had any effect on the rate of purchase.

The researchers discovered that the products displayed with a price ending in a 9 tended to outperform the other prices, even if the other price was lower. So a price of $39 resulted in more dress sales than the cheaper price of $34!

Who should use charm pricing?

The effectiveness of charm pricing depends on a number of things, but by far the largest consideration is the buyer and type of good sold. And while there are many factors that go into your price, the easiest way to get started is to ask yourself one question: do you want to be known for your prices, or your products?

If you want to be known for your prices, then charm pricing might be a perfect strategy for you. This is especially true if your products are elastic, and consumers don’t necessarily care about where they buy the product. So if you have a lot of products and want to be known as the cheapest option on the market, charm pricing will work well for you.

Charm pricing might also fit your strategy if you have products that people buy on impulse. The specificity of the price appeals to the “logical” side of the brain, and helps consumers justify their decision to add that small item to their cart at checkout.

When won't charm pricing work?

If you sell luxury goods you probably won’t want to use charm pricing. That’s because you want people to value the product itself, not the price. And in many cases, people won’t want to feel like they are getting a deal. As Nick Kolenda writes in The Psychology of Pricing Strategies,

If you sell luxury products, you WANT people to base their decision on your product qualities. You DON’T want them to consider the economic value. Thus, for luxury items, show the product, and THEN show the price.

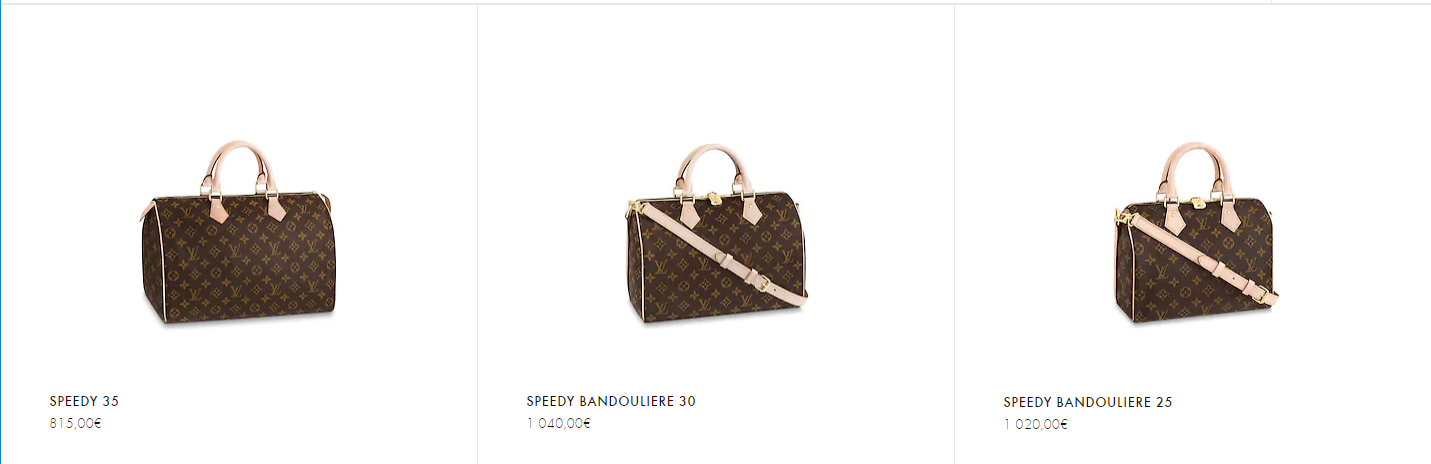

Take a look at these Louis Vuitton handbags below. Notice that none of the prices are even remotely close to the typical “19.99” infomercial style. Nor will they ever have a price like that. Instead, Louis Vuitton uses nice, round, whole numbers, and draw your attention to the product before you see the price.

Louis Vuitton has a high brand value, and their price perception is equally astronomical. When someone purchases a Louis Vuitton bag, they do so for the status of it. They don't care about whether they saved €10, and might even shy away from the discounted bags. So before engaging with charm pricing, you should think seriously about how you want people to perceive your company, then mold your pricing strategy around your goals.

Additionally, charm pricing does require a bit of nuance and market knowledge. Comparison shopping engines are sorted based on price, so you may want to use the exact same price as the lowest one listed. For example, if 5 retailers use 49.95 and you use 49.99 you will be number 6 on the list. You'll also stick out to consumers as overpriced.

You'll need to watch your market carefully, and adjust your prices often to stay relevant with charm pricing. And while this is time consuming if you manually update your prices and track the market, you can also use a software like Omnia to follow the market and adjust your prices for you. In Omnia, all you need to do is make a difference between prices <100 (.95 or .99) and >100 (no decimals). Then the algorithm will automatically adjust to that price whenever it updates.

Final thoughts

Charm pricing might seem like something restricted to bad American infomercials. But the reality is that it’s a powerful tool to have in your arsenal. Charm pricing helps draw attention to your products, and can give hesitant purchasers the small push they need to click “buy now."

Maintaining your charm prices, however, does require some work. And that's where a dynamic pricing software (or even a competitor pricing insights software) can make all the difference. Either of these softwares will help you save hours of time and capture more profits.