Is there anything that pairs better than e-commerce and direct-to-consumer (D2C) sales? With e-commerce, companies remove the inconvenience of having to go to a physical store, and products are shipped right to the consumer’s doorstep. D2C sales models are the perfect pairing: With all middlemen removed, the seller has total control over the customer experience.

In 2023, both established brands and digital native vertical brands (DNVB) are pursuing D2C strategies across a huge range of e-commerce verticals. In this article, we’ll highlight three especially interesting and competitive verticals in e-commerce – Electronics, Sports and Home & Living – and look at the current state of D2C businesses within these categories.

Trending Verticals in E-commerce

Worldwide e-commerce revenue is projected to reach €3.79 trillion in 2023, with the highest-selling verticals being fashion; electronics; and toys, hobby and DIY.

Omnia is especially interested in analysing verticals with multiple retailers selling the same or comparable products that consumers research heavily online. These verticals offer significant dynamic pricing opportunities, since price fluctuations are constant and competition is high.

Electronics

Consumer electronics continues to be one of the reigning e-commerce champion verticals, with sky-high sales over the last decade and further growth as work from home becomes a more established workplace vision for some professions. It is the second-most popular e-commerce category behind fashion, with expected revenue of €839 billion in 2023, or 22.1% of all online sales.

Sports

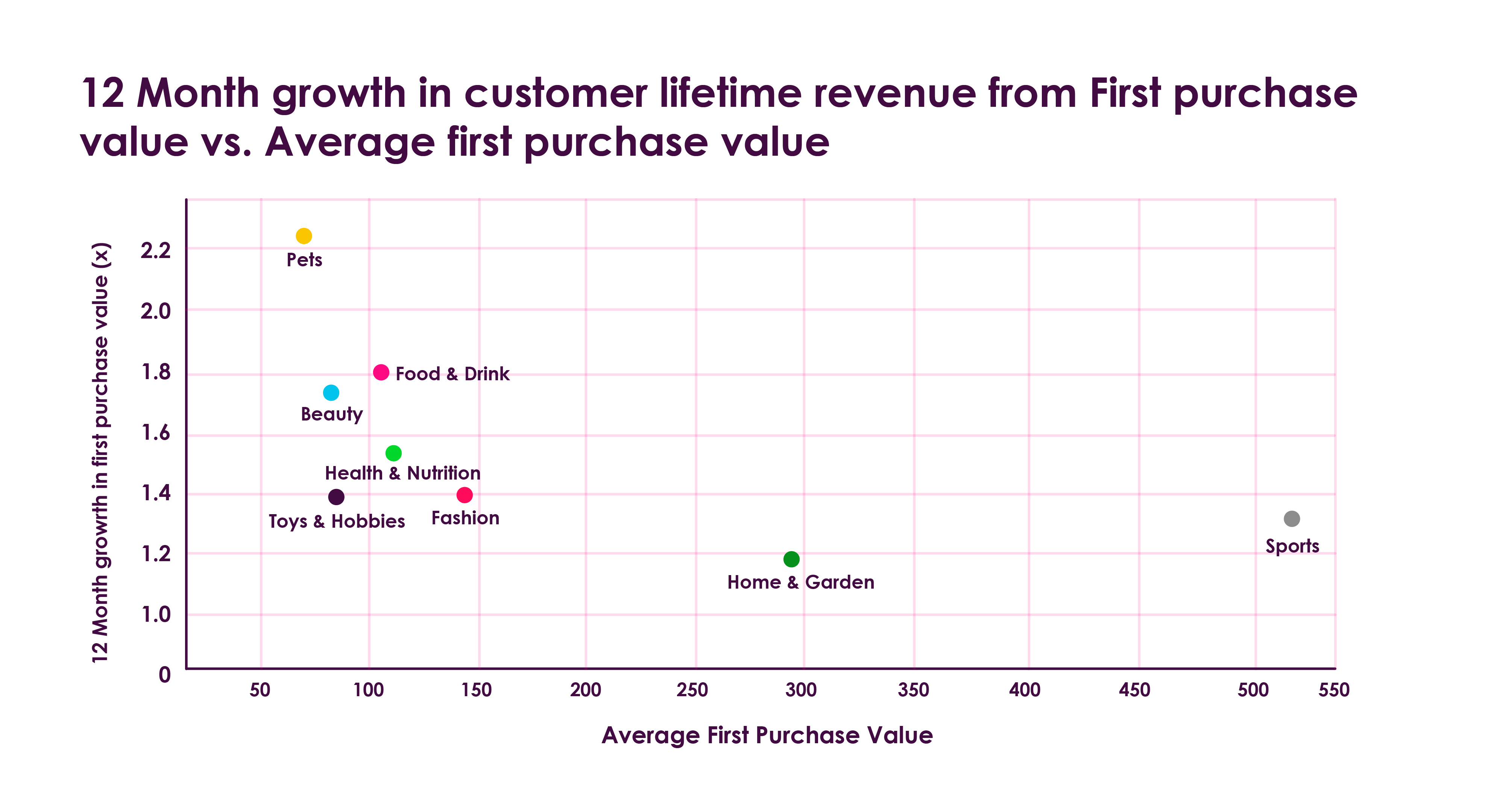

Sporting goods are a fast-growing e-commerce vertical, with 43.7% of sports products being bought online. The sports category is an interesting case because of its high Average First Order Value (AFOV). Businesses with high AFOV need to make a profit on every transaction, because repeat purchases are not as common in other verticals. The AFOV for sports businesses is extremely high, but it has one of the lowest levels of 12-month growth in Customer Lifetime Value (CLV). This is especially stark compared to a category like Pets, which has the highest rate of repeat purchases by far.

The sports vertical is continuing to grow in the post-pandemic landscape, with businesses in the US, UK and Europe seeing a boost in revenue and traffic in the first quarter of 2023 compared to the end of 2022:

- US sports businesses achieved nearly 10% in YoY revenue growth

- The UK and Europe are both still in negative territory for revenue change; about -20% YoY. However, this is a rebound from Europe being about -35% and the UK being about -30% at the end of 2022.

Home & living

As displayed above, the home category, like the sports vertical, has a high AFOV and a low rate of repeat purchases, sitting at 1.2 for the average first-purchase value. This puts pressure on businesses to achieve sufficient profit margin on each product. Home goods have faced some post-pandemic challenges, as people spent less time at home and less money on home improvement. This vertical has been slower to bounce back than other categories in terms of year-on-year revenue change, but businesses in the UK and Europe did see an improvement in Q1 2023 compared to the end of 2022. However, “improvement” is a relative term, as the YoY revenue change was still between -15% and -20% for the UK and Europe at the start of Q2 2023.

Talk to one of our consultants about dynamic pricing.

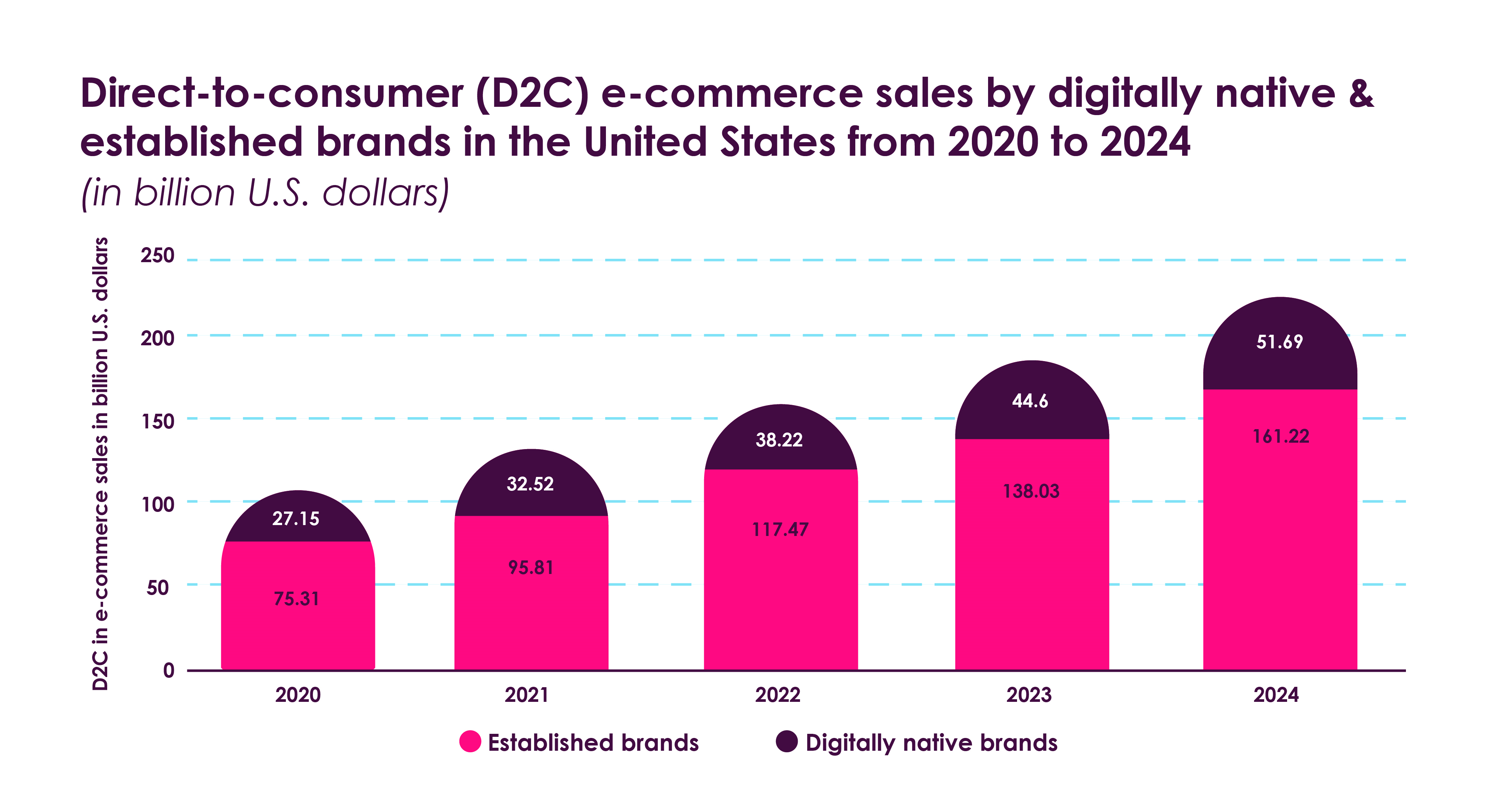

Current State and Outlook of D2C in E-commerce

Direct-to-consumer (D2C) brands are continuing to grow worldwide, with nearly two-thirds (64%) of consumers making regular purchases directly from brands in 2022. This D2C wave is present in a wide range of markets: in the US, D2C is forecast to grow to $213 billion USD by 2024; in Germany, D2C revenue was already valued at €880 million at the end of 2021; and in India, total D2C sales was $44.6 billion USD in 2021.

There are two types of brands that sell D2C:

- Digital native vertical brands (DNVB): Companies that were born online and have a strong digital presence. These companies often sell niche products directly to consumers through e-commerce platforms and social media, bypassing traditional retail channels.

- Established, traditional brands: Companies who have built a long-standing presence, reputation and customer base through various channels, including brick-and-mortar retail, advertising and other marketing efforts. These brands may have a strong online presence as well, but their roots are often in traditional manufacturing and distribution. In the US, 40% of established brands are already implementing a D2C growth strategy.

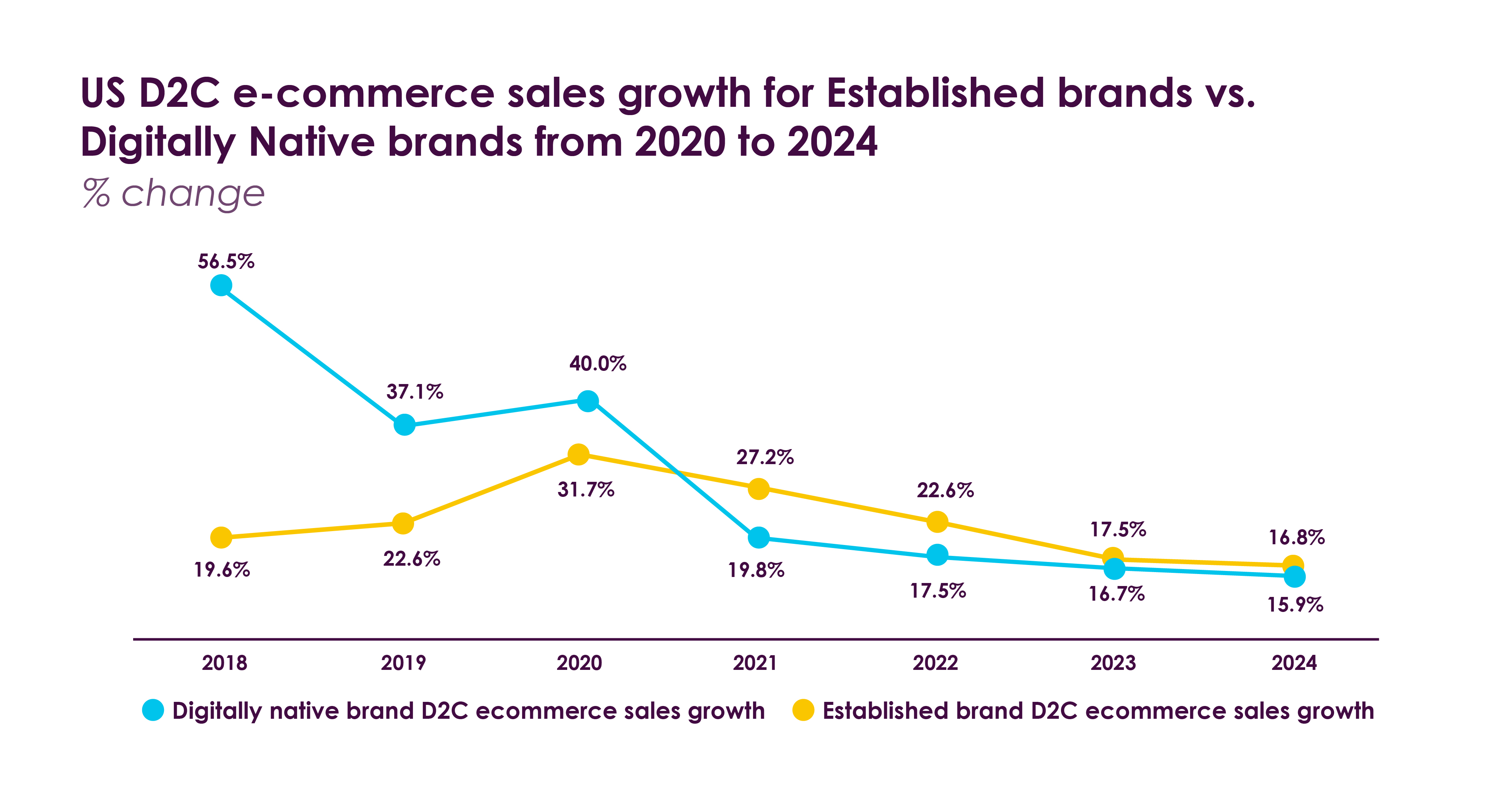

It’s a headline-grabbing topic of conversation, but how significant is the role of D2C in the wider e-commerce landscape? D2C sales would account for one in seven e-commerce dollars in 2022. And while DNVBs are often the brands capturing media attention, since they are generally more social media savvy, established brands are projected to account for 75.6% of D2C e-commerce sales in the US in 2023.

In fact, the D2C online sales for established brands have had a higher growth rate than DNVBs since 2021, although both types of D2C brands still show strong growth.

Challenges for D2C Brands

Every operator in the retail space faces its own unique challenges, but D2C brands are a unique case. They retain more control over their customer relationship, products, pricing and supply chain dynamics, but they also hold responsibility for the entire end-to-end experience and whether their product makes it into the hands of consumers. Challenges for D2C brands in e-commerce include:

- Customer Acquisition Costs: Competition for digital advertising space is high, and as a result, the cost of advertising on social media platforms, search engines and other channels can be quite expensive. This can be especially challenging for D2C startups and small businesses with limited marketing budgets.

- Supply Chain Management: D2C brands typically manage their own supply chain, which can be complex and time-consuming. From sourcing raw materials to manufacturing and shipping products, there are many moving parts to manage. Delays or disruptions at any point in the supply chain can impact product availability and customer satisfaction.

- Competition from Established Brands: As mentioned earlier, established brands with existing customer bases and sizable marketing budgets can be formidable competitors for DNVB brands. These brands often have more resources to invest in marketing and customer acquisition, and they may have stronger brand recognition and customer loyalty.

- Customer Experience and Service: D2C brands are often held to higher standards when it comes to customer experience and service. Customers expect a seamless, personalised experience when shopping online, and any issues with shipping, returns or customer service can lead to negative reviews and damage the brand's reputation.

- Scaling Operations: As D2C brands grow, they may struggle to scale their operations while maintaining quality and consistency. This can be especially challenging when it comes to managing inventory, production, and shipping logistics.

D2C Maturity in Key E-Commerce Categories: Electronics, Sports and Home

Let’s return to the three e-commerce verticals we discussed earlier. Each of these has its own level of maturity, as well as successful D2C brands, both established and DNVB.

Electronics

The consumer electronics vertical is relatively mature when it comes to e-commerce D2C sales. Over the past decade, there has been a significant shift in the way consumers purchase electronics, with many people choosing to buy products directly from brands online rather than through traditional retail channels.

Established brand: Apple

Apple has long used D2C retail operations to drive customers into its “walled-garden ecosystem”,and has made clear its plans to continue investing in D2C. It’s clearly working: the company was able to triple its market value to $3 trillion between 2018 and 2022.

DNVB: Anker Innovations

Anker, a Chinese mobile charging brand, is considered a pioneering DNVB. While they also sell via Amazon and other marketplaces, a majority of their sales still come from D2C.

Sports

The sports vertical has been growing more mature with D2C sales, as has been evidenced by the number of new DNVB brands such as Gymshark as well as established brands taking major steps to ramp up D2C efforts. Nike, for example, announced in 2021 that they would stop selling sneakers at American shoe store chain DSW, another in a long line of breaks with traditional retail. Reports like this are signals that, with Nike as one driver, the sporting goods and apparel sector is developing and maturing quickly, which are changes that retailers will need to adapt to.

Established brand: Nike

Nike has an established presence in traditional retail channels, but the company’s D2C operation, NIKE Direct, has been extremely successful in both e-commerce and brick-and-mortar. In 2022, it accounted for approximately 42% of the brand’s total revenue.

DNVB: Peloton

Peloton is one of the most successful examples of sporting DNVBs, having been born online before growing across different distribution channels, customer segments, geographies and categories.

Home & Living

The home and living vertical, which includes product lines such as furniture, cookware, bedding and more, is a strong D2C market due to its low barriers to entry and lack of strong retail competition.

Established brand: Vitra

Swiss company Vitra has been operating as a family business for 80 years. The company designs and manufactures designer furniture for use in offices, homes and public spaces.

DNVB: Westwing

Westwing was founded to be a “curated shoppable magazine”, where consumers could find beautiful home & living products online. The company is now present in 11 European countries and generated €431 million of revenue in 2022.

D2C Brands and Dynamic Pricing

Aligning prices with retailers for your entire product assortment is no small feat, which is why dynamic pricing software is so essential for brands who utilise a D2C sales channel. As Roger van Engelen, Principal at A.T. Kearney, told Omnia in a 2018 interview:

“In my opinion, brands need to have dynamic pricing before they start selling directly to consumers because it will prevent them from agitating their retail customers. This, in turn, protects brands from triggering a price-markdown war, which helps protect brand price perception.”

Keep in mind that most major retailers are already using dynamic pricing software for their e-commerce shops and to ensure products are competitively priced. As a brand, your use of Omnia will help you follow a market price even within strict limits.