Price Points by Omnia Retail

17.09.2024

17 Winning Pricing Strategies in e-Commerce

Setting the right price for your e-commerce products is like playing a game with extremely high stakes, no clear rules and ultra-intense competition. Choose the right price over time and you can win over your target...

Setting the right price for your e-commerce products is like playing a game with extremely high stakes, no clear rules and ultra-intense competition. Choose the right price over time and you can win over your target customers, creating loyal buyers who keep your business growing for years to come. Choose the wrong price and everything could go south, quick. So, how can e-commerce merchants choose the right pricing strategy or combination of strategies? In this comprehensive guide, Omnia covers 17 common pricing strategies in e-commerce and offers some advice for finding the right action plan for your business. What are e-commerce pricing strategies? E-commerce pricing strategies are approaches used by online businesses to determine, adjust and maintain the prices of their products or services over time. Strategies should take into account the company’s revenue goals, production costs, and other KPIs like customer lifetime value (CLV) and average order value (AOV). What is the difference between a pricing strategy and pricing rule? A pricing strategy is the high-level concept behind pricing decisions and policies, while a pricing rule is goal-oriented and about the actual execution of that strategy. Perhaps a retailer chooses a premium pricing strategy, where they price a product higher than market average, in order to increase the perceived value; for example, pricing a black chair higher than the average of all black chairs. The pricing rule in this case is the concrete translation of a price formula for a product or product group. In the Omnia platform, this would mean: New price = Market average price x 1.2 So, the price will be calculated and set to be 20% higher than the market average that day. With Omnia, this can be also combined with conditions, filters and more. The complexity of a rule is limitless. Top pricing strategies for retail and e-commerce There are endless examples of pricing strategies in e-commerce, so we compiled a list of 17 common types of pricing strategies below: Dynamic Pricing Dynamic pricing is a pricing strategy where companies or stores continuously adjust prices during the day to optimise margins and increase sales. The strategy applies variable prices rather than fixed prices, meaning they don’t have to decide on a set price for a season, but can instead adapt to the ever-changing market. It is important to note that although the two strategies are often confused, dynamic pricing differs significantly from personalised pricing, which focuses on the behaviours of an individual consumer and adjusts product pricing based on their past shopping experience. Premium Pricing Businesses using a premium pricing strategy want to keep their pricing levels higher than the competition. This can be paired with messaging and branding that shows customers why the higher price is justified. For a premium pricing strategy to work, sellers usually have to have some combination of a strong brand image, unique offerings or innovative product attributes. Examples of companies with a premium pricing strategy include Rolex, Apple and luxury fashion brands like Louis Vuitton and Chanel. Competitive Pricing One of the more common pricing strategies in e-commerce is competitive pricing, where sellers set their prices based on the prices of competitors. Competitive pricing is most often used by businesses operating in competitive markets or one with fairly similar products and little differentiation, as all sellers are then trying to win over the same customers. A competitive pricing strategy does not always indicate undercutting the competition, but rather setting prices in relation to competitors; this could mean setting product prices lower, higher or the same as competing sellers. Running a competitive pricing strategy with manual research can take a significant amount of time and is challenging in today’s fast-paced e-commerce environment. To make price adjustments for listings in real time, most companies use some type of Dynamic Pricing software. Value-based Pricing Value-based pricing, sometimes called value-added pricing or perceived value pricing, is a powerful strategy that requires a deep understanding of the market and of the value your products offer to potential customers. Sellers can use value-based pricing to shape how consumers perceive your product. Want to position yourself as a luxury brand, or to be the best value-for-money option? Price accordingly. Implementing value-based pricing demands extensive research into your target market and what the competition is doing, as well as reflection on and alignment with your business objectives. It will require collaborative effort across the organisation, but can create a very cohesive and effective pricing strategy. Price Discrimination Price discrimination, also called price differentiation or differential pricing, is a strategy employed by e-commerce companies to maximise profits by charging different prices to different customers for the same product or service, based on characteristics of the customer. The objective is to extract the maximum amount of consumer surplus and capture additional revenue based on individual customers' willingness to pay. To use this strategy, sellers make use of their vast amounts of customer data, including browsing history, purchase patterns, demographic information and geographic location. This data is leveraged to segment customers into different groups based on their preferences, behaviour and purchasing power. Once customer segments are identified, prices can be tailored to each segment's characteristics. For example, customers who have shown a higher willingness to pay in the past may be charged a higher price, while price-sensitive customers may be offered discounts or promotions to encourage purchases. The success of price discrimination in e-commerce relies heavily on sophisticated data analysis and algorithmic pricing systems. By leveraging customer data and market conditions, companies can optimise their pricing strategies to increase revenue and overall profitability. However, it is important to note that price discrimination can also raise concerns about fairness, privacy and potential consumer backlash if implemented in a way that is perceived as discriminatory or exploitative. Odd-Even Pricing Odd-even pricing falls under the category of psychological pricing strategies and taps into the psychology of numbers to influence consumer behaviour. Odd prices, like €5.99, are commonly used, but even prices, like €6.00, have their own psychological impact. This strategy can be employed in various ways, from offering strategic discounts to trying to create a memorable price point. For example, take a look at the difference between how luxury jewellery brand Tiffany & Co uses even pricing and more affordable brand Kay Jewellers uses odd pricing. Customers coming to Tiffany & Co. are looking for luxury items and are likely less price sensitive, so the company uses even pricing. Shoppers on the Kay Jewellers website may be more interested in finding a deal, so many of their prices use odd pricing and end in .99 or .95. Charm Pricing Charm pricing, also called psychological pricing, is similar to odd-even pricing, as it leverages pricing to evoke an emotional response and prompt action. This strategy is often observed in late-night infomercials, where potential buyers can be swayed by a price ending in “.99” or “.95” to make an impulse purchase. But infomercials aren’t the only place charm pricing is seen; many retailers use elements of this pricing strategy. There are a number of theories for why charm pricing is so effective: A perception of loss: This is when consumers value a product based on the loss they feel without it rather than the gain. In the Western world, most consumers read prices from left to right, so there is a high likelihood of grasping the first number as an anchor. Under this theory, that’s why €599 would feel so different from €600, even though there is only a separation of €1. A perception of gain: On the other side, perhaps consumers feel they have gained something, i.e. saved money, when they see an example of charm pricing. If the higher price of €600 is the anchor, then the lower price of €599 means you gained something and saved €1. This theory pairs well with the .99 or .95 pricing, which may make a consumer think they’re getting a discount. Specificity: With a charm pricing strategy, the price of an item is so specific that it can trigger a psychological response of customers believing it must be priced at the correct value. This is especially relevant if pricing is fractional, meaning it ends in a cent value. Example: Uniqlo Although the apparel brand rarely has sales, they signify to customers that they are getting a good deal by ending almost every price in “-9.90” or “-4.90”. Bundle Pricing Bundle pricing, also called product bundle pricing, is a strategy companies use to sell more items with higher margins while giving customers a discount for increasing the size of their order. Products are “bundled” so customers receive several different products as a package deal, costing them less than it would have if they made separate purchases of the included products. This incentivises purchases by creating higher perceived value and cost savings. E-commerce companies typically select complementary or related products and combine them into bundles to encourage larger purchases, increase average order value and enhance customer satisfaction. By offering discounted bundle prices, companies can attract price-sensitive customers, drive sales of slower-moving products and create a competitive advantage in the market. Promotional Pricing A promotional pricing strategy in e-commerce involves offering temporary price reductions or discounts on products or services to create urgency, stimulate sales and attract customers. The primary goals are usually to increase sales volume, clear out excess inventory, introduce new products or gain a competitive advantage. Promotional pricing can take various forms, such as percentage discounts, buy-one-get-one (BOGO) offers, limited-time sales, flash sales, coupon codes or free shipping. These promotions can be advertised or offered through any channel, from email marketing and social media to online ads or on-site banners. Predatory Pricing A predatory pricing strategy in e-commerce refers to a practice where a company deliberately sets extremely low prices for its products or services with the intention of driving competitors out of the market or deterring new entrants. By selling products at a loss or below cost for an extended period, the predatory pricer aims to eliminate competition and subsequently raise prices once competitors have been forced out. Predatory pricing is often considered anticompetitive and is illegal in many jurisdictions as it violates antitrust laws created for consumer protection and to ensure market competition is fair. Penetration Pricing A penetration pricing strategy is often employed by online sellers and business owners to attract customers to new products being brought to market. It involves offering an initial lower price than competitors to entice more buyers to purchase. The goal is to secure market share, undercut established sellers in the market and attract new customers who will remain loyal, even after prices are adjusted back up. For this e-commerce pricing strategy to succeed, however, there must be a high demand for the product. Without a significant market, penetration pricing becomes less effective. It's also important to make the price increases gradually to avoid competitors implementing their own penetration pricing tactics and stealing customers. Businesses employing a penetration pricing strategy will need price monitoring software to track and analyse average market prices over a set time period, then use the data to calculate introductory pricing. Price Skimming With a price skimming strategy, the product is initially priced high and then reduced later on, rather than starting with a low price like penetration pricing strategies. This approach aims to maximise short-term profits and segment customers based on how much they are willing to pay, and is often used for innovative products and products with high demand. The top level of customers, the most loyal ones, will buy at high prices. The seller can then continue accommodating new levels of potential customers by gradually lowering (“skimming”) the price. This practice continues until it reaches the base price. Price skimming can be a great way to quickly generate revenue and even break even with a lower number of sales, but companies must be able to rationalise the high price point, especially if the market is saturated and customers have other low-priced alternatives to choose from. One real-world example of a price skimming strategy is Samsung. When a new mobile phone release is planned and demand is high, the price is set higher to bring in more revenue and capture market share and attention from competitors like Apple. The newest model above, for example, retails for as much as €1.819,00 to start. After the demand and hype lessens, the company skims the price back down to reach more customers. Samsung Galaxy phones, for example, are priced to capture share from the iPhone. Price Optimisation Price optimisation is a practice used in most e-commerce businesses that involves analysing data from customers and the market to calculate and set the optimal price for a product. The objective is to find the ideal price point to attract customers and maximise sales and profits. The types of data used can range from demographics and survey data to historic sales and inventory. Pricing optimisation is similar to dynamic pricing, but while the former can be more of a long-term process, the latter is built more for rapid change and adjusts pricing based on real-time data. Surge Pricing Surge pricing is a pricing strategy that temporarily increases prices in response to high demand and limited supply. It is used in many industries, from hospitality and tourism to entertainment and retail. Here are three common types of surge pricing: Time-based: Adjusts prices based on the time of day or during special events and expected or real-time high demand periods. For example, online retailers raise prices between 9 AM and 5 PM when customers shop online during office hours, as well as during large, industry-relevant events, like the Olympics for sporting goods sellers. Weather-based: Incorporates weather forecasts to determine pricing decisions. When favourable weather conditions are expected, prices are increased. For instance, if the weather forecast promises good conditions for the summer, prices for beach goods, summer apparel and BBQs can be raised in anticipation of higher demand. Location-based: Adjusts prices based on the geographical location of the buyer. It is often observed in crowded cities or areas with high-income populations, where customers have a higher willingness to pay. Additionally, surge pricing may be used in places with above-average shipping costs, resulting in higher prices. Loss-leader Pricing Loss-leader pricing, often used as part of a penetration pricing strategy, involves intentionally selling certain products at a loss to attract customers and stimulate additional sales of other higher-margin products. The purpose is to entice customers with attractive prices on popular or essential items, with the hope or expectation that they will make additional purchases of complementary or higher-priced items. While the initial product may be sold at a loss, the strategy aims to generate profits through the sale of accompanying products or services. Effective implementation requires careful product selection, pricing analysis and understanding of customer behaviour to ensure the overall profitability of the business. Honeymoon Pricing Like penetration pricing, honeymoon pricing sets the initial product price low during launch to attract customers. This strategy is common in subscription models, where a low-priced starter offer entices customers who must then be retained. Retaining customers in this model can be achievable, however, since switching providers may be expensive or require too high a level of customer effort. Yield Pricing Yield pricing is a pricing strategy most often seen in the aviation and hotel industries. It involves pricing differently depending on when the customer makes the purchase. Airline seats, for example, are priced based on where you are in the booking period: Booking earlier gets customers a lower price, while late bookings are at a higher price point. This enables those airlines to avoid empty seats and lost profits. How to find the right pricing strategy for your e-commerce business Choosing the right e-commerce pricing strategy requires careful analysis and consideration, and it’s worth noting that most sellers use some combination of strategies. Here are five key steps to guide your research and discussions as you build your pricing strategy: Understand your market and customers: Conduct research to gain insights into customer preferences and market dynamics. Analyse costs and profit margins: Evaluate expenses and calculate desired profit margins to assess feasibility. Consider your business goals and value proposition: Align pricing with your objectives and unique value proposition. Test, monitor, and adapt your strategy: Implement and continuously evaluate your pricing approach to optimise results. Stay agile and regularly evaluate pricing against competitors: Keep an eye on the market and adjust pricing as needed to remain competitive. Over time, pricing strategies must adapt and evolve, both to keep up in the market and to meet the needs of the brand and product assortment. As you build, implement and execute your pricing strategies, Omnia Retail can seamlessly automate any strategy you choose, blending any combination of rules with advanced Machine Learning and AI algorithms. Learn more about our revolutionary and intuitive approach to Dynamic Pricing here. What is Price Monitoring?: Check out everything you need to know about price comparison and price monitoring. What is Charm Pricing?: A short introduction to a fun pricing method. What is Penetration Pricing?: A guide on how to get noticed when first entering a new market. What is Bundle Pricing?: Learn more about the benefits of a bundle pricing strategy. What is Cost Plus Pricing?: In this article, we’ll cover cost-plus pricing and show you when it makes sense to use this strategy. What is Price Skimming?: Learn how price skimming can help you facilitate a higher return on early investments.

17 Winning Pricing Strategies in e-Commerce

19.04.2024

Reflecting on Price Points Live: Lessons for e-commerce in 2024

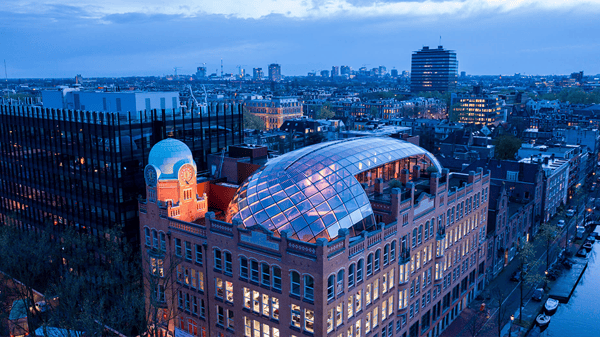

It’s been a few weeks since Europe’s e-commerce and pricing event of the year, produced and hosted by Omnia Retail, took Amsterdam by storm at the modern Capital C building in early March. Our invited guests were on the...

It’s been a few weeks since Europe’s e-commerce and pricing event of the year, produced and hosted by Omnia Retail, took Amsterdam by storm at the modern Capital C building in early March. Our invited guests were on the receiving end of the knowledge and expertise of some of the e-commerce world’s greatest minds and leaders, making for a successful annual rendition of Price Points Live. On this year’s stage was Prof. Hermann Simon, the co-founder and chairman of Simon-Kucher, who was a returning speaker at Price Points Live. He is known as the world’s leading expert on pricing and growth consulting. Also on the stage was Natalie Berg, an analyst, author and podcast host; Dr Doug Mattheus, a business executive and consultant in marketing, retail and branding; Gerrie Smits, a business consultant, speaker and author, and lastly, Cor Verhoeven, Group Product Manager at Bol, specialising in pricing and assortment insights. To conclude, the warm and confident Suyin Aerts returned as our host. Whether it be transparency in pricing, marketing or e-commerce practices, our panel of speakers bring more than a century of collective knowledge and experience to the table. So, what did our guests learn and take away from each of our speakers? What can brands and retailers understand about pricing, consumer behaviour and branding? Omnia shares the insights and knowledge pertinent to e-commerce success in 2024. Natalie Berg: E-commerce author and analyst “We are living in a perpetual state of disruption, and retail is no stranger to this, but the past few years have seen unprecedented levels of volatility and uncertainty,” shared Natalie. Whether we want to call it disruption, a seismic shift or a geopolitical and socio-economic tsunami, the one mitigating force to today’s ecommerce landscape was - and still is - Covid-19. “Covid has digitised our world - the way we live, the way we shop, or the way we exercise. And when it comes to shopping, most of it is still done in a brick-and-mortar store, but the majority of these sales are digitally influenced,” shares Natalie. This has brought brands and retailers to the popular omnichannel strategy, which has become more and more common and necessary. However, Natalie predicts that retail will start moving from omnichannel to ‘unified commerce’ which is “not just about being present in those channels but centralising those operations and connecting everything in real-time,”.. We see this already taking place with the partnership that shocked the e-commerce world in 2023 when Meta and Amazon announced that Meta users can shop Amazon products without even having to exit their Instagram or Facebook apps, creating a centralised and synonymous experience for social commerce and marketplaces’ shoppers. She goes on to speak about the customer’s time and how much more precious it is going to become for e-commerce and retail leaders. “28% of Amazon purchases take place in three minutes or less,” she stated,” so if you’re not saving a customer’s time, you have to be enhancing it.” A customer’s tolerance for mediocrity or for average service or experiences is getting lower and lower, which is how the customer experience has become the new currency. “It’s about really wowing your customers. Going beyond! Disrupting the status quo.” She shares that a new phenomenon is taking place because of this refreshed focus on the customer experience: The democratisation of white-glove service. “It’s a technology that is helping brands and retailers give this level of service,”.. This includes Walmart, in the US, which will go into your home to stock your kitchen with your newly purchased groceries while other retailers will collect your returns from your house when they make delivery, allowing the customer to kill two birds with one stone. Adidas in London has installed a system called “Bring it To Me” in change rooms where, if you want an item that’s in a different colour or size, a store assistant can collect it for you without you having to leave the change room. “Tech-enabled human touch - that’s what will separate the retailer winners from the retail losers,” Natalie argues. To conclude, Natalie speaks on how the use of AI will empower both e-commerce players and customers when shopping. “In the future, we won’t know where the physical world ends and the digital one begins,” giving an eerie yet exciting conclusion. “As a brand or retailer, standing still is the most dangerous thing you can do.” Dr Doug Mattheus: Consultant and branding expert Hailing from South Africa and living in the UK is Dr Doug Mattheus whose presentation focused on the art and science of brand building. So, what makes a brand long-lasting? “It is a mix of tangible and intangible features that, if properly managed, creates influence and generates value,” says Doug. But, as we’ve seen brands rise and fall over the last few decades, what are some of the factors that have created the most valuable brands in the world, from Apple to Mercedes Benz to Walmart? Creating a brand hook The ways in which a customer can get hooked on a brand are limitless: Reflecting back to the time he received his first pair of Nike shoes in high school, the one item Doug cared about keeping just as much as the shoes themselves was the box they came in. “It wasn’t just a box - it was a Nike box.” Fast-forward to adulthood, he visited a Harrods store and witnessed customers buy empty single-use packets and bags with the Harrods logo on them. In a more recent case, the fragrance of bath bombs and body scrubs in the air at a mall or airport has become one that is synonymous with LUSH. “Just follow your nose,” says Doug. “So, what is your brand hook?” On the contrary, we see brands like The Body Shop that have struggled to keep up with digitally-native challenger brands like Drunk Elephant, Glossier and Paula’s Choice in the personal care market and is undergoing mass closures across the US and EU. Doug’s advice to brands is to create a unique hook - whether it be in the sights, smells, sounds or physical world. What’s your differentiator from competitors? A small player in the award-winning wine industry in South Africa is a vineyard called Vergenoegd Wine Estate. By a large stretch, it is not the most well-known or award-winning brand. However, this boutique vineyard did not refrain from harnessing the commercial value of organic farming. The winemakers introduced runner ducks to the vineyard, which roamed around eating worms, snails, and bugs that could be detrimental to the vines. In addition, these ducks became a tonic for families and couples with kids wanting to experience the vineyard while having something fun for children. The ducks have become a unique feature to Vergenoegd Wine Estate and a key driver of foot traffic and revenue. “This is a great example of how a small player is not being defined by its smallness and not being intimidated by bigger players.” Multiple touchpoints for customers Stemming from Natalie’s thoughts on brands having to go the extra mile to impress customers, Doug shares that there are moments of magic around us at all times, and it is up to business leaders to find and develop those moments. However, where there is ease and innovation between brands and customers (like at Nordstrom in Seattle, USA who did not want to lose their “eyeball moments” with customers from rapid digitalisation, began offering curbside pick-up so they can still have face-to-face interactions with shoppers), there are also moments of friction and time-wasting that cause frustration for customers. It’s about fine-tuning interactions and creating moments that make a brand memorable. Relevance: Do you reinvent like a butterfly or a bull? As the title suggests, brands in many verticals, but especially in fashion, personal care, sporting goods, fitness, and electronics, are faced with the rapid rise of digitally-native brands that exist to challenge the status quo. In fact, these brands, which have only known a digital world, are, in fact called “challenger brands” because of the innovative approach to design, production, supply chains, customer interactions, marketing, and everything under the e-commerce sun. According to Doug, brands who reinvent like a butterfly are those who can go with the changes and challenges in front of them with agility and resilience while those who face reinvention like a bull may be stubborn and ignorant and may face their own downfall. Cor Verhoeven: Group Product Manager at Bol. Coming from one of Europe’s largest and most successful marketplaces, Bol., Cor Verhoeven delved into pricing, specifically how Bol. tackles bad prices on the platform and what the negatives are for a marketplace or e-commerce brand. “We have 38 million items for sale, 13 million active customers, and 50,000 unique selling partners. That means almost every home in the Netherlands and Belgium has bought something from Bol.,” says Cor. With numbers like that, it’s more than possible that a marketplace would run into pricing issues. “Part of our strategy is to make Bol. an equal playing field. Our sellers must be able to make a living off what they sell on Bol. - it’s not just us that needs to do well.” So, how does a customer-centric pricing strategy fall into this? “We all work hard to make sure that the price of an item is not the reason someone doesn’t buy something on Bol.,” says Cor. “Pricing is important because it positions you in a competitive market, it establishes customer trust, and it establishes customer lifetime value. Our success is caused by growth, monetising and retaining in a loop,” explained Cor. “Our three main beliefs when it comes to pricing are High-quality deals, trustworthy and reliable prices, and competitive prices in line with the market.” The balancing act between insult pricing and best-in-market pricing is tricky and precarious, which is why Bol. judges their products on their prices. “If a product’s price is above an allowable price, we take it offline to product the customer,” Cor stated. How does Bol. decide on what is an allowable price? “We source benchmarks. If a product has a benchmark, it’s given a classification - an insult price or an allowable price - and business rules are set,” explained Cor. “When we don’t have a price benchmark, that’s when we have little control.” When Bol. doesn’t have a price benchmark for a product, they utilise their data science model to predict a price while, daily, the model is manually looking for prices to benchmark those products.” The result is a price for a product that is more aligned with the market and within the boundaries of what a customer will accept. “Of course, taking insult prices offline decreases revenue, but what we get back in return is way bigger. The seller sees increased conversion,” said Cor. Sander Roose: CEO and Founder of Omnia Retail Joining the panel was our very own CEO Sander Roose who started his keynote speech by making good on a promise. “At the last Price Points Live event, I promised that Omnia would release a new platform sometime in 2023, and the whole Omnia team is proud to have achieved that.” As a veteran in the dynamic pricing industry, with 12 years at the helm of Omnia Retail, Sander brought to the stage what he believes are the pricing elements and design principles of successful dynamic pricing. According to Sander, there are three factors to successful dynamic pricing implementations: Clearly defined objectives; securing engagement and support; and the spirit of continuous learning. “Without clear objectives, you can have a strong pricing platform, but you won’t know how to harness it,” he said. “And as the market changes, you need to be able to change your objectives.” For the second factor, pricing managers and teams need to be fully on board: “If they don’t understand how prices are calculated, they will reject the implementation as a whole.” Then, the third factor speaks to a dynamic pricing user's ability to be agile and curious: “We see that customers that used the system most intensively to make iterations with their prices get the best results.” As a result, Omnia found that two key design principles for dynamic pricing success are necessary: flexibility and transparency. “Being able to automate any pricing strategy you can think of, to facilitate all the objectives, to keep control while the system is on autopilot, and finally, making sure the users are adopting the system.” Flexibility and Transparency A pricing platform needs to be able to support a vast array of pricing objectives and strategies. “A platform needs to be able to endure various high-level objectives. Perhaps on a global level, you have a profit maximisation objective while the strategy on lower levels, such as on a per country basis, may be different,” explained Sander. “For example, if your global brand has just launched in the Netherlands, you may want to maximise market share. Then, even further down, depending on your various verticals, you may want a stock-based strategy.” Flexibility must also be present not just in pricing strategies but in data collection and the recalculation process. Using the example of a Tesla self-driving car with a blacked-out windscreen, Sander makes the point that customers of dynamic pricing still need to be able to see and understand what’s going on - even if the system is on autopilot: “If you create transparency while the system is on autopilot, you can create buy-in from internal stakeholders and facilitate learning loops.” How flexibility and transparency exist in Omnia 2.0 The culmination of these two values resulted in the Pricing Strategy Tree, developed specifically for Omnia 2.0, making strategy building and interpretation easier and faster. “The copy-and-paste feature means a large D2C brand that wants to launch in a new country can simply execute their entire pricing strategy with just a few clicks by copying the strategy in the tree from another country. This is huge for an international customer to be able to do this.” Another feature called Path Tracking allows you to visually see how your strategy came to be, step by step. “This feature helps to validate if you set up the tree how you intended to,” explained Sander. Another feature that elevates transparency is Strategy Branch Statistics which works to answer burning questions from pricing managers: ‘Which part of my strategy is most impactful? The Strategy Branch Statistics feature works to show you which business rules are doing the work to give your prices.’ An additional feature highlighting transparency is the ability to name branches within the tree. The names not only help coworkers understand what you’ve built, but they differentiate the various strategies that are at play at the same time. Strategy Branch Statistics feature works to show you which business rules are doing the work to give your prices.’ An additional feature highlighting transparency is the ability to name branches within the tree. The names not only help coworkers understand what you’ve built, but they differentiate the various strategies that are at play at the same time. AI in pricing “From private label matching, creating automated weekly reports to send to category managers, to automated insights, AI is a powerful technology that has the potential to contribute to the superpowers we offer customers,” says Sander. However, as of today, Sander believes that AI is one part of the machine and should not be considered the holy grail of price setting. “The true need is goal-based pricing,” Sander says.”AI is a means and not an end.” Sander's vision for AI in Omnia’s pricing platform sees a move from granular pricing strategies that affect the business’s objectives to a scenario where the customer sets the objective, and the Omnia platform automates and optimises prices. “We want to move more and more towards goal-based pricing in our platform. We believe the end game for price automation will be rules and AI, not just AI, and the Pricing Strategy Tree allows for a rules and AI combination.” Prof. Hermann Simon: Founder of Simon-Kucher, author As a world-renowned expert in pricing and consulting, Prof. Hermann Simon joins the panel to share what he thinks are the hidden champions in e-commerce and retail and what their successful strategies are. Specifically, the small and midsized global market leaders with a market share of above 50% and that are little known to the public. “In China, which is by the largest global exporter, 68% of the exports come from small and midsized companies, and behind this number are the hidden champions,” says Hermann. “Inside super export performance requires large companies plus a very strong mid sector. Hidden champions, not large corporations, determine whether a country really excels in global competition. Hidden champions are an untapped treasure to learn about business success.” Focus and Globalisation What characterises these companies? “The three pillars of the hidden champion’s strategy are ambition, focus, and globalisation fueled with the tools of innovation, value and price,” shares Hermann. Focusing on your product makes your market small. How does hidden champions enlarge their market? An example of successful globalisation is Karcher, the global leader in high-pressure water hoses, which began internationalisation in the 1970s slowly and then accelerated in the 90s to become the global market share leader at 70%. Other examples include Deichmann, the largest shoe retailer in Europe, which sits in 31 countries across Europe, Africa, the Middle East and the US. “The lesson here is that if you have a good product, multiply it by regional expansion,” says Hermann. Value and Price For successful companies, value comes from innovation and a closeness to the customer. But what drives innovation? The answer is different for hidden champions and the average company. Below is a pie chart where we can see how little an average company prioritises customer needs: What is the most important aspect of pricing? “It’s customer-perceived value. The willingness to pay is a mirror of perceived value, and therefore, value equals price,” explains Hermann. “Understanding, creating and communicating values are the key challenges in pricing.” Using the example of the iPhone, the cost has always been above the market average for a smartphone, yet the success of the product indicates it must obviously bring value to the customer. “Value drives price,” concludes Hermann. According to internal studies at Simon Kucher, only one-third of companies can say they have real pricing power. So, two-thirds are exposed to the sensitivities of the customer. “The result is that value-to-customer and pricing power is created by differentiating your product, changing the way customers perceive your products and your price, and changing the mindset and confidence of your own people in your company,” says Hermann. Closeness to customer “88% of hidden champions say that closeness to the customer is their biggest strength, even more than technology,” says Hermann. Simon-Kucher found that 38% of employees at hidden champion companies had regular contact with customers, while large corporations only had 8%. In retail, it is difficult to understand value perception because there are many competitors selling the same thing. This makes retail’s soft parameters, such as the store layout, service and friendliness, more helpful in understanding value perception. The challenge then becomes how do enterprises effectively communicate their value offering. “Hidden champions are true value leaders with their intense closeness to customers. They achieve a more profound understanding of a customer's needs; their continuous innovations create higher value, and they integrate customer needs and technology much better than the average company.” Gerrie Smits: Speaker and author Gerrie believes we’re getting customer-centricity all wrong. From his 25-plus years of experience in helping companies prioritise customers as well as how to deal with the changing digital world, he has found a common thread of issues: “Technology is getting in the way, companies are seeing customers as a target, and teams are siloing their responsibilities and not wanting to take on other responsibilities,” says Gerrie. “Companies are getting tech just for the sake of it, not because there is any use for it. If you’re going to invest in tech, make sure you have a competitive edge.” According to US business leaders, the number one skill a company needs to have to succeed in the digital world is empathy. “Technology is fantastic if you know what to do with it. My clients are driven by technology, and that’s not customer-centric.” When it comes to companies seeing customers as a target. “I’ve never met a company that doesn’t say they’re customer-centric - obviously,” says Gerrie. But there is a large difference between intent and action. “For example, Amazon has always said they are obsessed with understanding the customer. Yet still, they got it wrong when, in 2022, they reportedly lost $10 billion from dismal sales for their voice-activated Echo. “What brands need to understand is that there is only a small part of me that is your customer. The rest is me as a human being,” says Gerrie. “Seeing your audience as buyers, you are not fulfilling the whole potential.” Concluding Price Points Live 2024 In closing, our panel speakers joined Suyin on stage to answer a round of interesting questions and to share their final thoughts. “To drive loyalty, one must understand what your customers value,” said Natalie, while Doug shared that although pricing is vital to brand loyalty, it is not the only factor. Answering a question about how smaller players in e-commerce can grow and succeed against large enterprises, Natalie says, “It’s like Prof. Hermann said: It’s about focus. You have to know what your strengths are, and then you have to execute really well.” The world of e-commerce is set to make $6.3 billion in global sales in 2024, which is expected to increase to $8 billion in 2027. However, what’s more interesting is the amount of e-commerce users which is set to increase to 3.2 billion by 2029 - a third of the current world population. More shoppers don’t necessarily mean more revenue and sales, so it is safe to say that brands and retailers need to focus their efforts on pricing, innovation, unique marketing and frictionless experiences if they want a segment of the ever-growing pool of e-commerce users. With these insights and go-to strategies for elevating the success of brands and enterprises, Omnia is excited to see what the e-commerce landscape will be for our customers and other growing e-commerce companies. We’d like to thank all of our speakers - Natalie Berg, Dr Doug Mattheus, Prof. Hermann Simon, Gerrie Smit, Cor Verhoeven and our own Sander Roose - and our host, Suyin Aerts, for their knowledge and time spent at Price Points Live 2024. Watch keynote presentations here.

Reflecting on Price Points Live: Lessons for e-commerce in 2024

05.03.2024

Transparency in e-commerce: Leading the conversation at Price Points Live 2024

Europe’s e-commerce and pricing event of the year is returning in 2024, as Omnia Retail gears up for another exciting edition of Price Points Live. As leaders in e-commerce pricing across Europe, Omnia Retail is...

Europe’s e-commerce and pricing event of the year is returning in 2024, as Omnia Retail gears up for another exciting edition of Price Points Live. As leaders in e-commerce pricing across Europe, Omnia Retail is perfectly positioned to bring together experts and leaders in retail, pricing, marketing and branding to share insights and knowledge. Taking place at the modern Capital C building in Amsterdam on 7 March 2024, the building’s majestic glass dome ceiling sets the tone fittingly for this year’s main topic: Transparency. Whether it be transparency in pricing, marketing or e-commerce practices, our panel of speakers bring more than a century of collective knowledge and experience to the table. Joining us is Prof. Hermann Simon, the co-founder and chairman of Simon-Kucher who is returning to Price Points Live for a second visit. Known as the world’s leading expert on pricing and growth consulting, Prof. Simon is an award-winning author. Also on this year’s stage is Natalie Berg - an analyst, author and podcast host - who will add value to the conversation on all things global retail. Dr Doug Mattheus, a business executive and consultant, will be bringing his 35-years of knowledge and experience in marketing, retail and branding. Lastly, Cor Verhoeven is a Group Product Manager at one of Europe's largest marketplaces, Bol.com, specialising in pricing and assortment insights. He’ll be bringing his entrepreneurial spirit and his 10-plus years of e-commerce, product management and marketplace experience to Price Points Live. Our speakers will be brought together by the charming Suyin Aerts, who is also a returning panel member. Challenges in today’s world of e-commerce What are brands and enterprises facing in e-commerce in 2024? From branding to pricing to consumer behaviour, the e-commerce arena has experienced more phases and changes in the last four years that it did in the previous decade. Let’s discuss some of the industry’s key trends and issues as of today. Growing competition and price-war strategies As e-commerce grows and oversaturates each vertical, consumers have more choice and power. This is not necessarily a bad thing, however, it does mean that brands and retailers start employing more competitive pricing strategies that ultimately lead to price wars between competitors and a race to the bottom. This undercuts the value of products and only results in losses for each business involved. This has been evident with smartphone brands like Samsung and Huawei who competitively lower the prices of their smartphones to achieve higher market share. It’s also common between wholesale retailers like CostCo and IKEA or large online marketplaces like Amazon that employ tactics to get their vendors to sell their products lower than on any other marketplace. Increased customer expectations For decades, the relationship between retailers and consumers had been dominated by the former. Customers had only a few options for where they trusted to purchase their groceries, shoes, school supplies, winter essentials and everything in between. Today, that relationship has been flipped on its head as consumers enjoy the pick of the litter in just about every retail vertical. As this trend has developed, consumers have come to expect faster shipping, better prices, higher quality, and more benefits for their loyalty. This will naturally affect a brand or retailer’s pricing strategies as they try to maintain customer retention and even attract new customers with promotions, benefits from loyalty programs and clubs, and bundles that appeal to shoppers. Changing customer loyalty What makes a customer loyal to a brand? At what point does a customer’s loyalty erode? And, what are the factors that could cause this to happen? For most customers, it’s a balancing act between quality and cost. However, in 2024, brands and enterprises must face other factors that could affect customer loyalty: Sustainability efforts. A 2023 McKinsey and NielsenIQ study found that products with ESG claims (environmental, social or governance) accounted for 56% of the total sales growth during the five-year period of the study, from 2017 - mid-2022, showing, for the first time, that brands with some kind of sustainability mention are growing faster than those without. This is all due to changing customer loyalty and the very parameters that shape and shift that loyalty. Social changes may be another factor. For example, in the sporting goods vertical, participation in social sports like pickleball and paddle tennis have increased by 159% while lacrosse, skiing and track declined by 11%, 14% and 11% respectively. Stubborn inflation The issue that has plagued global e-commerce since 2021 is still having its ripple effects on the industry in 2024. In the first quarter of 2024, the EU has already cut GDP growth expectations for the year from 1.3% to 0.9% as interest rates remain high while consumers still grapple with a 40% increase in gas and food prices that peaked in 2023. With this reality, pricing has never been more important nor more sensitive to the consumer. McKinsey’s latest ConsumerWatch report shows that shoppers were buying less items at the end of 2023 compared to the previous year’s period, with personal care dropping 3%, household items dropping 3% and pet care dropping 5% which results in AOV (average order value) loss. The importance of transparency in pricing software The use of dynamic pricing in e-commerce has grown exponentially in the last decade, however, that does not mean every software provider offers the best-in-class platform. Not every pricing tool is made equally. Transparency is something that has not been prioritised as a core tenet of pricing software, which has often allowed for a murky relationship between a brand or enterprise and their own pricing strategies. For a user of pricing software to experience the full potential of a pricing tool, they need to be able to build, test and edit each pricing strategy with clarity and ease. They need to be able to understand how and why a pricing recommendation has been made. They should be physically able to see every pricing strategy simultaneously at play without convolution or confusing coding jargon. While this may seem obvious, some pricing platforms have found that withholding pricing knowledge from a customer is the way to go. How is Omnia enhancing transparency? When Omnia set out to build its new pricing tool, named Omnia 2.0, its main goal was to create a next-generation platform that would enhance a user’s flexibility, user experience and transparency. Why was this necessary? The reason is two-fold: Pricing for SMBs and enterprises can be overwhelming, time-consuming and confusing. For enterprises, as assortments become larger and competitors thicken the competition, pricing may become more complicated. “As the ability to run detailed and complex pricing strategies has become mainstream, it has snowballed into the next level of challenges: Complexity overload,” says Omnia’s CEO Sander Roose. By developing our one-of-a-kind Pricing Strategy Tree™ coupled with information dashboards that give a God-like view of the market and every strategy you have at play, pricing becomes what it should always be: Transparent, flexible and simple. “Omnia 2.0 successfully cuts through the clutter,” says Sander. Another development that enhances transparency for users of Omnia 2.0 is the “Explain Price Recommendation” feature which provides a full explanation of how the price advice of a particular product came to be. This not only enables full control over how and why prices may change but it increases the customer’s pricing maturity. “The ‘Price Explanation’ visually tracks the path through the Tree to show the logic and how the price advice came about,” explains Sander. Join us at Price Points Live 2024 “Although at Omnia we believe it’s still day one in terms of building the ultimate pricing platform we are building towards in the long-term, we are very proud of how the Omnia 2.0 next-generation pricing platform gives our users of and customers ever growing superpowers,” says Sander. Join our exclusive annual event by reserving your seats on our Events page or simply email your dedicated Customer Success Manager who will assist you. We’ll be seeing you in Amsterdam!

Transparency in e-commerce: Leading the conversation at Price Points Live 2024

08.02.2024

Omnia’s work on company culture takes centre stage in Frankfurt, Germany

“Even if you don't manage company culture, a specific culture will emerge. Although it probably won't be the culture you envisioned,” says Omnia Retail’s COO Vanessa Verlaan who presented on the topic of building a...

“Even if you don't manage company culture, a specific culture will emerge. Although it probably won't be the culture you envisioned,” says Omnia Retail’s COO Vanessa Verlaan who presented on the topic of building a strong and healthy workplace culture at the annual World Class Workforce Transformation conference in Frankfurt, Germany in January. In sharing Omnia’s experiences, failures and successes in building a healthy company culture, Verlaan shared that it is not something that can be achieved if only one part of the company is actively trying to enforce it: “I am convinced everyone in the company should be responsible of company culture. Not just HR. It starts with the leadership team and then it can be scaled.” Covid-19 has upended how leaders interact with employees and how coworkers connect with each other," a Harvard Business Review article by Denise Lee Yohn says. "Culture has become a strategic priority with an impact on the bottom line. It can’t just be delegated and compartmentalised anymore,” says Yohn. In many cases, a company’s core values are used to attract and hire top talent and remain a calling card on a company’s website. But what happens when the experience does not match the initial expectation? “People have certain expectations when they start at a company and then when faced with the reality, they are disappointed, and then leave. That’s when companies have to rehire for the same positions. This is why core values need to be implemented from the leadership team and throughout each department,” shares Vanessa. Using this simple yet effective system, Verlaan explains how the expectation-reality gap can be closed if culture plays an unconditional role in every step of the employee life cycle: Professionals from DHL Express, Siemens, Allianz Global Investors and Celltrion Healthcare also shared presentations on upskilling, digital transformation in the workplace, employee engagement, and other interesting topics that affect teams across the continent, making this one of the most innovative and forward-thinking events dedicated to the employee experience. In addition to the case study presentation, Verlaan also participated in a roundtable discussion with professionals from other private companies which further unpacked the topic for employees at corporations, scale-ups and start-ups. In talking to one of the fellow speakers who experienced that her previous leadership team was not supportive of implementing a specific workplace culture throughout the company, Vanessa believes that there are further opportunities regarding the practices for companies that want to achieve a strong and positive corporate culture. “Culture persists only because people act in ways that uphold its principles and codes,” says a Stanford Social Innovation Review paper, echoing the sentiment that Vanessa shared in her presentation. As Omnia has grown over the years, expanded in locations and developed each department, one thing has stayed the same - its core values. “We don’t update our core values because they are the foundation. However, they have become more clear and implemented in various steps,” says Vanessa. Omnia Retail's COO Vanessa Verlaan enjoyed snapping some photos at the event with fellow speakers in between interesting discussions on company culture.

Omnia’s work on company culture takes centre stage in Frankfurt, Germany

18.01.2024

The Future of Retail: Navigating E-commerce Trends and Innovations in 2024

E-commerce had a volatile 2023. From declining sales in luxury to behemoth partnerships to the resurgence of influencer marketing, the last 12 months experienced several changes and surprises that even the analysts were...

E-commerce had a volatile 2023. From declining sales in luxury to behemoth partnerships to the resurgence of influencer marketing, the last 12 months experienced several changes and surprises that even the analysts were not expecting. Reflecting on the performance and strategies of social commerce platforms, brands and marketplaces in 2023 has set the scene for a fast-moving and competitive market for 2024. Omnia looks at how the previous year ended within e-commerce and what industry players and shoppers may expect in 2024, in addition to the innovation that might change the future of retail. Social commerce will show its teeth Within the e-commerce landscape, it was the expansion of social commerce that made the largest leaps and bounds, proving once again how it has become the largest growing sub-industry within retail and e-commerce with an expected value of $2 trillion in 2025. Forbes predicted that social commerce is growing three times faster than e-commerce while the moves and counter-moves made in 2023 mirrored why: Meta and TikTok are not interested in your lunch selfies anymore. They’re interested in your likelihood to shop. With Meta’s new partnership with Amazon, allowing Facebook and Instagram users to shop Amazon ads directly in the app, a new era of e-commerce is forming that further increases Amazon’s control of the market and further drives Meta’s plans to create shopping-first platforms. Other social commerce companies such as TikTok, which is owned by Tencent in China, will also be focusing on establishing itself as a legitimate e-commerce and influencer marketing platform in the West. TikTok Shop’s launch in the US in September is set to disrupt both the social commerce and marketplace arenas for 2024. TikTok and Instagram are each other’s biggest competitors, thickening the hunt for consumer attention and loyalty. Instagram and Facebook are still the world’s top choices over TikTok for buying products, however, the difference is incremental: In Germany, 46% of shoppers use Instagram while 42% use TikTok. In the US, it’s 42% and 40% respectively, and in the UK, TikTok surpasses Instagram as the platform of choice (39% vs 35%). Despite TikTok’s incredible growth and influence, Omnia predicts that Meta’s new Amazon deal will keep them out of the top position for the foreseeable future. The Implications of TikTok's Ban on E-commerce Retailers The potential ban of TikTok in the United States carries significant ramifications for e-commerce retailers, who have increasingly leveraged the platform for marketing, sales, and customer engagement. TikTok, known for its highly engaging short-form videos and robust algorithm, has become a powerful tool for brands seeking to reach a young, tech-savvy audience. Here’s an exploration of the key implications: Loss of a Major Marketing Channel TikTok as a Marketing Powerhouse: With over 1 billion monthly active users worldwide, TikTok has emerged as a crucial marketing channel for e-commerce brands. The platform's unique algorithm promotes content virally, often reaching millions of users organically. For many retailers, TikTok has been instrumental in driving brand awareness and engagement through influencer partnerships, user-generated content, and creative campaigns. Impact of the Ban: If TikTok were to be banned, e-commerce retailers would lose access to this vast audience. Brands that have heavily invested in building a presence on TikTok would need to shift their strategies quickly. This disruption could lead to a temporary decline in visibility and engagement, impacting sales and customer acquisition efforts. Shift to Alternative Platforms Exploring New Avenues: E-commerce retailers would likely diversify and redirect their marketing efforts to other social media platforms such as Instagram Reels, and YouTube Shorts. These platforms offer similar short-form video features, which can help brands maintain some continuity in their marketing strategies. Challenges and Opportunities: Transitioning to new platforms may require additional resources and time to build a comparable follower base and engagement level. However, this shift could also present an opportunity for brands to diversify their social media strategies and reduce dependency on a single platform. Impacts on Sales and Revenue Sales Generation via TikTok: TikTok's "Shop Now" buttons and seamless integration with e-commerce platforms have enabled direct purchases within the app, boosting sales for many retailers. Revenue Risks: The ban would disrupt the revenue stream, especially for brands that have seen substantial sales through TikTok. Retailers would need to find alternative methods to drive direct sales, such as enhancing their websites' shopping experiences or investing in other social commerce tools. Influence on Consumer Behaviour Consumer Habits: TikTok has influenced consumer behaviour by making shopping more interactive and engaging. The platform's algorithm personalises content based on user preferences, making it easier for brands to target potential customers effectively. Behavioural Shifts: Without TikTok, consumers might shift their attention to other platforms, altering the dynamics of online shopping. Brands will need to adapt their strategies to align with changing consumer behaviours and preferences. Talk to one of our consultants about dynamic pricing. Contact us AI and E-commerce in 2024 Artificial Intelligence (AI) is transforming e-commerce in various ways, and many technologies that retailers use daily are AI-driven, even if not immediately apparent. Here are six of the most common AI applications in e-commerce: Personalised Product Recommendations: Collecting and processing customer data about their online shopping habits is now easier than ever. Retailers rely on machine learning to capture data, analyse it, and use it to deliver personalised experiences, implement marketing campaigns, optimise pricing, and generate customer insights. Over time, machine learning will require less involvement from data scientists for everyday applications in e-commerce companies. Retail analyst Natalie Berg shares: ‘’AI is going to make retailers smarter leaner more efficient. And it's going to make our experience as customers as you can tell. It's going to make it more personalized more relevant’’ Customer Segmentation Access to more business and customer data, along with increased processing power, enables e-commerce operators to better understand their customers and identify new trends. Smart Logistics Machine learning's predictive powers shine in logistics, helping to forecast transit times, demand levels, and shipment delays. Smart logistics use real-time information from sensors, RFID tags, and similar technologies for inventory management and better demand forecasting. Over time, machine learning systems become smarter, building better predictions for supply chain and logistics functions. Sales and Demand Forecasting Especially in times after COVID-19, planning inventory based on real-time and historical data is crucial. AI can help with this. A recent McKinsey report suggests that investment in real-time customer analytics will continue to be important for monitoring and reacting to shifts in consumer demand, which can be harnessed for price optimisation or targeted marketing. These applications highlight how AI is revolutionising e-commerce, providing enhanced personalisation, operational efficiency, and smarter business strategies. Marketplaces will face stiffer competition with less market share Niche marketplaces within luxury such as Yoox Net-A-Porter (YNAP), Farfetch and Matches almost ended in collapse in 2023, however, Farfetch was saved by South Korea’s e-commerce giant Coupang in a last-minute sale, Matches has been purchased by UK retailer Frasers for €60 million, while YNAP is still searching for a saviour to bring them into the black since the sale to Farfetch fell through. According to Vogue Business, Amazon or Alibaba could potentially purchase YNAP, two of the world’s biggest e-commerce platforms, further strengthening their grasp on the marketplace landscape. As mentioned above, Amazon has continued its growth and consolidation by entering the social commerce space with Meta, which was announced in November, and the results of this deal will play out interestingly throughout 2024. How will this affect other marketplaces? In 2024, marketplaces will feel the pinch of the Meta-Amazon coalition as an increasing number of lucrative vendors will turn toward Meta platforms to make sales and grow their brands. As a result, consumers will go where there is variety with a competitive price and an easier shopping experience. However, if more shoppers will be heading toward Meta platforms, marketplaces may be able to take advantage of the increased traffic with new advertising, sales and pricing strategies. Marketplaces other than Amazon will need to incentivise shoppers to choose their platform - whether it is via social media or not - to remain profitable. Although Zalando ended off 2023 with declined quarterly sales, their new partnership with Highsnobiety has led Omnia to believe that they too have noticed the e-commerce success that lies within content. Europe’s largest marketplace has realised that many customers, especially Gen Z and millennial shoppers, buy into content and not products. The new platform, entitled Stories, creates fashion-related video content and provides news of collaborations and interviews with designers. “We know that customers are looking for inspiration and with Stories on Zalando we are doing exactly that: crafting highly engaging formats to show what’s new and what’s next in fashion,” says Zalando’s Senior Vice-President of Product Design Anne Pascual. Brands will restrategise marketing and sales strategies to regain sales Brands in multiple categories, especially in fashion, beauty and luxury, experienced a cooling period in 2023 that lasted longer than expected. For some, this will extend into 2024: Burberry’s shares have dropped 15% after they reduced their profit outlook thanks to a quieter-than-expected sales period over Christmas. Nike is cutting jobs and is set to reduce $2 billion in costs over the next three years amid dwindling sales. Gucci’s brand equity dropped 31% from 2022 to 2023, while L’Oréal and Lancome list 20% and 19% respectively. Overall, the annual Kantar BrandZ report concluded that the world’s top 100 brands lost 20% of their value in 2023, leaving them on the back foot as 2024 gets underway which will see brands moving and shaking to get into a profitable, growthful place again. Despite the overall lookout, other brands in some verticals including sports apparel and performance footwear did well such as Swiss-owned running shoe maker On which saw third-quarter sales increase by 44% and HOKA, which consistently saw growth throughout 2023 and gained in market share. In 2024, On is focusing on building its D2C channel which will cut into market share controlled by Adidas and Nike which have seen declining market share at Dick’s Sporting Goods, one of the US’s largest shoe retailers, while On and HOKA increase. Source: Reuters 2024 trends in sports apparel include a transition from logo-heavy designs, which we saw gain prevalence within “quiet luxury”, to “quiet outdoors”. Brands like North Face and Arc'teryx will be focusing on gaining the attention of luxury buyers who want in on sportswear with a high-end feel. Conclusion As we move into the second half of 2024, the e-commerce landscape is set to become even more dynamic and competitive. The developments in 2023, including the rapid expansion of social commerce, strategic partnerships, and the resurgence of influencer marketing, have laid a robust foundation for the coming months. Social commerce, driven by giants like Meta and TikTok, will continue to evolve, with new features and integrations aimed at enhancing the shopping experience. Meta's partnership with Amazon and TikTok's efforts to solidify its position as a key e-commerce player will significantly shape consumer behaviour and market dynamics. However, the potential ban of TikTok in the US could disrupt these trends, forcing brands to adapt quickly. Marketplaces will face increased competition as the Meta-Amazon coalition draws more vendors and consumers to their platforms. This shift will compel other marketplaces to innovate and offer unique incentives to retain their market share. Strategic partnerships, such as Zalando's collaboration with Highsnobiety, highlight the importance of content-driven commerce in attracting and engaging younger audiences. Brands, particularly those in fashion, beauty, and luxury, will need to re-strategise their marketing and sales approaches to recover from the prolonged cooling period of 2023. While some brands face continued challenges, others in niches like sports apparel are poised for growth, leveraging direct-to-consumer channels and tapping into emerging trends like "quiet outdoors." In summary, e-commerce in the second half of 2024 will be characterised by rapid adaptation, and a focus on personalised, content-rich consumer experiences. Brands will need to leverage strategic partnerships with influential platforms and content creators to stay relevant. The successful players will be those who can seamlessly integrate innovative technologies and data-driven insights to create engaging, tailored shopping journeys for their customers.

The Future of Retail: Navigating E-commerce Trends and Innovations in 2024

26.12.2023

Sustainability: Footwear gains traction in creating a circular economy

Reincarnating the shoe - that’s what some global brands in footwear are attempting to do with sustainability’s latest solution to a mounting climate change problem. A circular economy refers to an ecosystem where...

Reincarnating the shoe - that’s what some global brands in footwear are attempting to do with sustainability’s latest solution to a mounting climate change problem. A circular economy refers to an ecosystem where fashion is designed with its end-of-life state being top-of-mind. Circular fashion and footwear are designed specifically to be recycled into new items made from the old. From the individual fibres of a t-shirt to the type of glue that binds shoe parts together, circular fashion is dedicated to reimagining how garments are made to avoid deeper damage to the planet and its resources. Up to 92 million tonnes of clothing and footwear end up in landfills around the globe each year, making the fashion industry one of the most significant contributors to waste and carbon dioxide emissions. “Circular fashion is a closed-loop system that aims to design out waste,” states the Sustainable Fashion Forum. Europe’s share of footwear consumption in 2022 sat at 14.9% of the global total, equaling 3.58 billion shoe purchases across the continent, and of those shoe purchases, how many can we say once had a life in another home on another foot as another shoe? As circularity initiatives grow for clothing and accessories through resale marketplaces and brand-run programs, shoes have been largely left behind. However, 2023 saw a positive uptick in footwear brands who want to see their shoes live several lives. Omnia delves into why it’s so difficult for shoe brands to create circularity and who’s doing it right. Why it’s harder for shoe brands to create circularity vs clothing It may be harder, but it’s still possible, and brands are proving it. Footwear is generally made to last longer than clothing, especially in the sports and outdoor aisle, with plastic, rubber and leather used for most shoe products. National Geographic reports that 47% of all footwear is made of plastic and rubber, making the 23.9 billion shoes produced globally in 2022 one of the most sustainably challenged products in retail and textile production. Clothing, on the other hand, is a much simpler item to create a circular ecosystem with, as items usually involve one to two materials. “Footwear has up to 200 different parts that go into one shoe,” says Adidas’ Senior Director of Sustainability Viviane Gut. Because of this, some global fashion companies have made concerted efforts to install circularity initiatives including H&M’s goal to become completely circular by 2030 by utilising 100% recycled and sustainability-sourced materials. There’s Farfetch, the UK-based marketplace for pre-owned luxury fashion and accessories, whose second-quarter results for 2023 showed 4.1 million active shoppers and a 40% year-on-year increase in supply growth. In essence, creating a more sustainable t-shirt or reselling a used blazer is less expensive and more seamless than going back to the drawing board of recreating how the shoe is made. However, this doesn’t mean it isn’t being done: In November, the Business of Fashion reported that eight global brands including New Balance, Crocs, Target, Brooks Running, Reformation, Ecco, Vibram and On are banding together under the name The Footwear Collective to share knowledge and resources to expand the circular shoe economy, which is the first of its kind within the shoe market. In addition, Nike debuted its first circular shoe in August 2023 entitled ISPA Link Axis. As the world’s largest sneaker producer, Nike calculated their carbon footprint to be over 11.7 million metric tonnes of CO2 in 2020 alone, equating this impact to what the entire city of Amsterdam, Netherlands may offset in the same period, further proving how necessary it is for global brands to create circularity and end-to-end sustainability. Each component of the shoe is made from recycled materials and no glue, making it the ideal shoe to be disassembled and reinvented once more. Assembling the Link Axis is also more energy efficient, as it does not require time and resources to glue the sole to the upper parts of the sneaker. Nike ISPA Link Axis Talk to one of our consultants about dynamic pricing. Contact us Where does the circular economy begin? Creating a closed-loop ecosystem where garments essentially never become waste is central to a circular economy. However, at the heart of the conversation, the first question brand leaders and retail entrepreneurs can ask themselves is, if we can’t rely on consumers to resell our garments or take part in branded circular initiatives, how do we kickstart circularity from the inside out? How do we at least guarantee that our manufacturing and production practices are low-impact? Allbirds, the shoe brand that’s made a name for itself for its innovation in sustainability and carbon offsetting, has already done more than most to create a greener product when they launched a sneaker in 2015 made out of Merino wool from sustainable farming and recycling. The sneaker’s fame came from the fact that it only had a small carbon footprint of 9.9 kilograms, however, this success only motivated Allbirds to go further. In mid-2023, the brand launched a new sneaker at the Global Fashion Summit in Copenhagen that offsets 0.0 kilograms of carbon dioxide, making it one of the first sneakers to be carbon neutral. For Allbirds, this is all part of their long-term goal of reaching a 50% reduction in their carbon footprint by 2025, culminating in a 0% carbon footprint by 2030. Allbirds The Moonshot In essence, circularity needs to start at the root including materials, manufacturing, transportation, product use, and end-of-life which may include the resale market, return initiatives, brand-run programs, and recycling. New rules for the new world The very first shoe, created approximately 9,000 years ago and discovered in California, USA, was made out of sagebrush bark that simply covered the toes and the sole. Today, the sophistication and variety of footwear are evident from Prada to Nike to Timberland and everything in between. As fashion and footwear brands continue to release new items in the coming decades and centuries, one thing is for certain: The rules for producing, manufacturing and discarding will change. Policy, public scrutiny and changing consumer behaviour will edge and direct brands to revisit their production, distribution and end-of-life methods time and time again to ensure greener products are the end result. Creating and taking part in a circular economy for shoes and fashion is one of the best solutions for brands and consumers to lower their carbon footprint, reduce landfill accumulation and make full use of the materials used. “When you use materials seven, eight, or 10 times over, then the footprint goes down dramatically,” said On’s co-founder Caspar Coppetti to the Business of Fashion, the Swiss shoe brand that’s been backed by Roger Federer. “You have to really go to the source and develop new processes, new technologies, scale them … and then there’s a lot more investment needed.”

Sustainability: Footwear gains traction in creating a circular economy

14.12.2023

Black Friday sales increase, but holiday spending looks shaky

Consumers showed their resilience once more for Black Friday 2023 amid global economic turmoil as sales increased across multiple channels, categories and markets. Shopify and Adobe all shared positive year-on-year...