Price Points by Omnia Retail

15.10.2020

Omnia's Customer Success Philosophy

Set up for success. Yes, product is important. But what matters more is how the product helps you reach your goals. That’s why at Omnia, in addition to giving you the best dynamic pricing solution on the market, we...

Set up for success. Yes, product is important. But what matters more is how the product helps you reach your goals. That’s why at Omnia, in addition to giving you the best dynamic pricing solution on the market, we deliver it with an entire team dedicated to your success.

Omnia's Customer Success Philosophy

15.10.2020

High-quality Data is Expensive, and That's a Good Thing

That’s right. High-quality dynamic pricing data costs money, but it’s money you should be happy to spend. Why? Here are four things you should know about data quality with pricing (and why it’s important you get the...

That’s right. High-quality dynamic pricing data costs money, but it’s money you should be happy to spend. Why? Here are four things you should know about data quality with pricing (and why it’s important you get the best data out there).

High-quality Data is Expensive, and That's a Good Thing

15.10.2020

Retail Pricing Wars Report

Automation in the UK Retail Industry? Omnia was curious, so we surveyed the top 150 retailers in the country to find out how they use automation.

Automation in the UK Retail Industry? Omnia was curious, so we surveyed the top 150 retailers in the country to find out how they use automation.

Retail Pricing Wars Report

15.10.2020

Why Pricing and Marketing Go Hand in Hand

Get your data to work for you. Whether you have thousands of products or millions, your pricing and marketing insights can do more for you. Whether it's discovering the most profitable products to advertise on or...

Get your data to work for you. Whether you have thousands of products or millions, your pricing and marketing insights can do more for you. Whether it's discovering the most profitable products to advertise on or connecting your online and offline stores, combined marketing and pricing data lets you run a more effective, agile, and profitable store.

Why Pricing and Marketing Go Hand in Hand

15.10.2020

7 Ways Pricing Insights Make Your Job Easier

Download the whitepaper to learn: How you're wasting 25% of your week on manual price checking. Why Omnia customers love Pricewatch What the benefits of pricing insights are for your company.

Download the whitepaper to learn: How you're wasting 25% of your week on manual price checking. Why Omnia customers love Pricewatch What the benefits of pricing insights are for your company.

7 Ways Pricing Insights Make Your Job Easier

15.10.2020

Pricing and Data Quality

Quality data is the foundation for any dynamic pricing solution. Just like any other software, clean data means the difference between a pricing solution you can trust and a pricing solution you grow to hate. Click one...

Quality data is the foundation for any dynamic pricing solution. Just like any other software, clean data means the difference between a pricing solution you can trust and a pricing solution you grow to hate. Click one of the pages on the right to explore why data quality is so essential to pricing.

Pricing and Data Quality

15.10.2020

What to Look for in a Dynamic Pricing Solution

If you’re a retailer or a brand, pricing is one of the linchpins of your overall commercial success. And if you’re considering a dynamic pricing solution, we understand that finding the right one for your organization...

If you’re a retailer or a brand, pricing is one of the linchpins of your overall commercial success. And if you’re considering a dynamic pricing solution, we understand that finding the right one for your organization is of the utmost importance. The world of dynamic pricing is overwhelming at the start. That’s why we created this guide to help you make the choice for yourself. So what does your dynamic pricing tool need to for you to achieve real results? Here’s the shortlist of 12 different criteria that you should look for in any solution you consider, regardless of which software vendor you use.

What to Look for in a Dynamic Pricing Solution

14.10.2020

The shift to Direct to Consumer

14.10.2020

Price Points Podcast EP 6: The Power of Customer Success

What is "Customer Success," and why is it so important to dynamic pricing? Omnia Vice President of Customer Success Haiko Krumm tells all in this episode of Price Points. [00:00:11.120] - Grace Hello. I'm going to Price...

What is "Customer Success," and why is it so important to dynamic pricing? Omnia Vice President of Customer Success Haiko Krumm tells all in this episode of Price Points. [00:00:11.120] - Grace Hello. I'm going to Price Points, the podcast that examines the changing world of e-commerce, one episode at a time. I'm your host Grace Baldwin. And last time we posted I talked with our Product Manager Berend about what it takes to build a complete dynamic pricing platform from a technical perspective for this episode. I wanted to talk about dynamic pricing success from the other side of the equation the user base inside dynamic pricing can be a big organizational change and it creates a whole host of opportunities but it's also complex and it touches a lot of different areas within your organization. So how do you manage that change and ensure that you're getting the most out of the tool. I sat down with Haiko Krumm, our Vice President of Customer Success, to discuss how Omnia helps customers feel happy with their dynamic pricing I go began at Omnia about a year ago but he has a long history of working in the field of customer success. It's something he's truly passionate about and since he's joined we've made pretty amazing strides at Omnia. In this episode we talk a lot about what customer success means to him. The changes he's brought to Omnia and more. So sit back, relax, and enjoy this interview with Haiko. Thank you for meeting with me. Can you maybe introduce yourself a little bit and talk about who you are and what you do here. And yeah just your overall roll. [00:01:39.750] - Haiko Cool, will do so. My name is Haiko within Omnia I'm responsible for Customer and Partner Success. A bit myself first. I'm 41 years old, I live in Amsterdam, I have a son of eight and a wife. Love Amsterdam, won't ever leave it. And about Customer Success within Omnia I'm responsible for Customer and Partnership Success. To start off with Customer Success I think it's very important as we as a company sell in principle a product that's about pricing a marketing automation but the product itself doesn't make customers successful and doesn't directly deliver any value. So a Customer Success team is responsible to help our customers get the most out of our products and therewith achieve value and stay as a happy customer and become brand advocates. [00:02:36.410] - Haiko Thank you so much. [00:02:37.360] - Grace But this isn't a new role to you. You were Vice President of Customer Success at Insided, correct? [00:02:42.330] - Haiko Yeah that's correct. [00:02:43.150] - Grace Yeah. So one step before that before I was at InSided I had— I've been a Marketing Consultant which I loved because you see a lot of different companies and can help them out but there was also a little bit too passive for me because it's a lot about defining strategies, giving workshops and creating reports. But in the end you never know whether that really turns into value. So I thought I would like to be a little bit more active really making sure that that stuff happens. And next to that I also wanted to be a little bit more in an entrepreneurial environment. So by then that's now I have to think like nine or 10 years ago even I by coincidence came into contact with Robin where there's an online community company and I thought these communities make a lot of sense from a marketing and customer service perspective. And he was an entrepreneur so I thought let's just have a lunch with him and do some knowledge sharing. And during that lunch a lot about communities made sense to me but also Robin told me he actually wanted to pivot a business model from owning his own communities to facilitating those for larger companies. And that made a lot of sense to me. And after a couple of brainstorms he asked me what I would like to join. And actually that's immediately helped me to become more entrepreneurial of course. So basically I started off there creating the proposition as it wasn't there, creating sales material, websites. Did sales, got the first customers onboard. And then of course we promised a lot. And then we had to make sure that stuff really happened so I did project management, consultancy, account management, etc. During this journey I more and more saw that my passion is more on the customer side instead of the sales side, as you really build up a relationship not with a company only but also with people within the company. And my passion is really to make them successful. [00:04:47.230] - Grace Why is that a passion for you? [00:04:48.960] - Haiko Yeah, so what I really like is to build a long term relationship with uh with people and to really accomplish something. I mean sales is just the start of the journey and it's super important uh part of course but it's just a start. And I'd rather really build up a relationship and in a couple of years together look back say wow we we really accomplish this and it's a mutual benefit. I mean of course companies pay money for our services but if they do so with joy, that's the best situation I think we we can have. [00:05:21.490] - Grace So if you say you know you want dynamic pricing you're choosing between different companies why do you think customer success is so important to figuring out which company you want or you want to go with? [[00:05:30.940] - Haiko So the definition of customer success is that customers achieve their ever evolving value they want to get out of our products. So as said, the product by itself doesn't deliver any value and we can just deliver a platform for whichever retailer or brands but it won't do anything. So taking one step back and that's of course also my proficiency but I believe that customer success is crucial for each SaaS, software-a- a-service, you buy as yeah just having this platform won't help you out by itself. And I think it's especially for dynamic pricing crucial as dynamic pricing of course directly impacts your overall company results. And it touches upon many different departments finance to marketing and last but not least but not least it's really a complex matter and you really have to have a clear strategy on your pricing and be able to translate that into your pricing rules within Omnia. But that's only where the journey starts. After that you want to learn you want to use the insights you you get out of a platform because we have a lot of rich data and you have to turn it into insights and continuously optimize your strategy based on these insights. And yeah that's a lot more than just the platform by itself. So I really believe that customer success is crucial for for getting the most out of the dynamic pricing. [00:07:03.210] - Grace So do you feel like our dynamic pricing tool is sort of like a hammer and the customer success team is showing you how to actually use it? Or is maybe a better analogy is a power tool so maybe like a circular saw and then for instance showing you how to use it safely and how to actually get the most out of it right? [00:07:21.610] - Haiko Yeah I like that analogy. Thanks. I will use it more often and if I would think uh onwards in this uh philosophy then I would rather uh call it the toolkit. 00:07:32.850] - Grace A toolkit, yeah. [00:07:32.880] - Haiko With a lot of different uh possibilities. If you look at our platform it's pretty exciting what's possible with it. But indeed you have to understand what's to do with it. And first of all you have to have a plan, actually, of what you want to do because if you have a toolkit and you just start hammering nails into the walls that won't happen. But if you have an idea to actually build a house then you have to start to really think through that already and to map stuff out and then start working on it. And that's indeed exactly what Customer Success is about. So you actually automate the biggest part of your assortment continuously which is a quite a challenge. [00:08:05.070] - Grace And so how have you embedded this sort of philosophy into Omnia? So something that's been done since you first started here is we now have kind of core sections within Customer Success. I'm wondering if we can maybe talk a little bit about each of those. So you have Onboarding, Customer Success Management, Knowledge and Strategy, and Support and so you're responsible for all of that, correct? [00:08:27.450] - Haiko That's correct. So uh also nice to start in this order. Onboarding is actually the starting phase. So if a customer starts to use Omnia, we know this is super crucial period where the customer is excited but also gave us a lot of trust and has to learn everything still about a platform at least. So in this period of approximately two to three months we really deep dive into the tool and not only making sure that it's technically implemented but that's the as said strategies are really translated into pricing rules that the customers really understand how the tool works and are able to use it themselves instead of that we should be doing it for them. [00:09:17.880] - Grace So it's partially making making sure the customer feels comfortable with the tool before you really kind of let them do their own thing, right? [00:09:31.500] - Haiko Yeah exactly. So it's it's uh making sure it is really implemented and live. But also that it shows the first initial value and that customers indeed trust the tool and are able to independently work with it, correct. [00:09:47.870] - Grace Yeah. And so then the next part the next part of this process is customer success management right. Or is it knowledge and strategy. [00:09:55.340] - Haiko No. The. Yeah. That's a bit the the same but. So for if you look at a proactive process we start with the onboarding and after the Onboarding we move over to Customer Success Management. And Customer Success Management is about continuously checking, okay what is your objective with the tool? What are your strategies and what do we actually want to achieve in the upcoming year? And then do regular check ins whether that's indeed working or not. And also making sure that customers really know what is happening at Omnia, what is on our roadmap, what we have delivered, how they can use it. So that's the proactive contact we have to make sure that customers get the most out of the products. And it's not about only the the contact and relationship but it's also about really diving into the metrics we have of our customers and making sure that they're on the right way. [00:10:47.010] - Grace Okay. And then knowledge and strategy what's next. [00:10:50.950] - Haiko Yeah. So uh we have a lot of expertise on pricing and marketing and of course our own tool. And uh mostly that knowledge lies with uh with uh the consultants and of course all product management. And as we are as software as a service company we don't say want to do a lot of one on one consultancy because that's not really scalable and that's also not our business model to do by-the-hour consultancy. So that's why we tried to create more generic knowledge uh and share our expertise. And that's be done mostly by the consultants so they create a knowledge base with a lot of articles we create blogs. We do a lot offer analysis which we want to share with our customers so that all the customers benefit from the work that we do and indeed again are able to get the most out of their pricing and marketing. [00:11:47.080] - Grace And do you see customer communities as part of a future within knowledge and expertise? [00:11:51.240] - Haiko Yeah that's a that's a nice one of course that's my background within, within Insided and I definitely believe that that it can help and especially also because now we have a lot of expertise. But the more and more customers we get the customers in the end of course know even more than we do. And communities are a great way to capture that knowledge and share it among the customers and making it a total more interactive platform. So I definitely do believe that's in which phase of the company I don't know yet. [00:16:01.830] - Grace And does Omnia and let you do that? [00:12:23.730] - Grace Yeah. Yeah but I mean I do think it's pretty cool because like for example but we had a customer independently come up with something that we'd been thinking about for a while but they were actually testing it and their strategy is working. And so it would be cool for them to be able to share that more easily with other with other customers. [00:12:42.330] - Haiko Absolutely. And also a lot about, of course, our platform development. So both communicating what has been developed how you can use that and if customers have any questions they directly can do so and other customers also see these questions and answers but also on product feedback. What do you like uh what what would you see different in our platform and by voting you know which is the most important for customers. Instead of just one customer asking something and then you have to say no because hey it's not the most important but then it's super transparent and also insightful for us. [00:13:18.270] - Grace The last step in the process is customer support which is a little bit different, I understand, right, than Customer Success. So maybe you can talk about that. [00:20:08.170] - Grace Do you think it's worth it for enterprise companies to try and build their own dynamic pricing system? [[00:13:26.790] - Haiko So in principle Customer Success is more a proactive approach where we continually help our customers proactively. And customer support is more reactively. So if customers still needs helps on something, still has questions or indeed if something's going not the right way. If there are issues with imports exports then of course we still need somebody to help these customers out. We have our Product Specialist Jelmer there. So we also define it as a Product Specialist and not as a support agent because he's not just simply following scripts but he's really expertise guy on our platform and knows on some points even more on the platform compared to the Consultants or the Product Managers as he's continuously diving into the stuff that happens with our customers and is really making sure that customers get the most out of it again. [00:14:25.800] - Grace So how did you come up with these four different parts? [00:14:29.010] - Haiko Yeah. So as I a bit explained within Insided I moved into this Customer Success but that was still with a with a consultancy mindset really doing one on one consultancy helping each customer out but that's of course not scalable. And like five years ago I believe the Customer Success proficiency actually came up and that's still the same mindset making customers successful. But then in an efficient and scalable way more really with a structured process. [00:14:59.850] - Grace And that's the customer success proficiency? [00:15:01.740] - Haiko Exactly. And that that totally made sense to me. So I really dived into that gate side as a company SaaS company that really fueled this customer success movement. So I read a lot of books about it, joined conferences, follow each blog there is about this, but also I do a lot of one on one knowledge sharing with peers and I also facilitate a Customer Success a leadership Meetup like two to three times a year. So really to keep up with what is happening and also be able to translate that in actual actions and strategy and tactics we can use as Omnia. [00:15:43.650] - Grace Okay. I didn't know that about you. So how big is that event then, that Meetup that you host? [00:15:48.720] - Haiko And that's not too big. Actually uh because uh usually if you go to conferences you hear the showcases and how great everyone is doing. [00:15:48.720] - Haiko And that's not too big. Actually uh because uh usually if you go to conferences you hear the showcases and how great everyone is doing. But that's most of the times not the things you can learn from you. You learn from each other's challenges and falls and and more deep dive in setups. So that's why there's this meetup is only like I believe eight to 10 people. And we are really transparent there of what do we do and what is working what isn't working and each time we have a different [00:16:32.970] - Grace Yeah and I imagine it's probably also probably better rather than going to a conference once a year to act to have multiple touch points throughout the year. That's sort of the same thing here with our, we do EBRs multiple times a year. To make sure people are on track and they're getting the most out of the product and we don't wait for a catastrophe or for like a once a yearly review right. [00:16:54.930] - Haiko Absolutely and and also I think the difference is that conferences mostly are somebody presenting and learning from that's where both the EBRs as the meet ups are more interactive so that you actually can ask a debate about things. So getting some more deep learning instead of just scratching the surface. [00:17:18.060] - Grace So what makes Customer Success at Omnia different than at other organizations? [00:17:22.980] - Haiko Yeah I think uh that's based on the passion there already was within the company and the knowledge before I came. So Sander our CEO is really an expert on this matter. We have consultants said are really experts and so does these this expertise and already having the passion to really make our customers successful has been embedded in the company for for many years and I think what I tried to contribute to that is to make it more structured and scalable from now on. [00:17:58.950] - Grace What about partnerships. What role do partnerships play in customer success? [00:18:02.550] - Haiko Yeah that's a good question because we decided to make it the responsibility of partnerships also within the customer success teams who is actually customer and partner success. [00:18:13.960] - Grace Why did you decide to do that? [00:18:15.320] - Haiko Yeah. So it both is about the long term relationship and getting mutual value. So both our relationship with our customers as our relationship with our partners. And within Omnia we also defined partners and partnerships as really of strategical value. So first of all we of course have our marketing and pricing platform but it's fueled with competitive data and competitive data we get by our data partners or data partners so there are actually a crucial part of our proposition. And next to that we also have partnerships with for instance Microsoft, Google, a lot of strategy consultants. So we believe there's a lot of value in and in partnerships both for partners as for us as for the customers of course. And that's it's a pretty similar dynamic compared to customer success. We decided to have that in the same department. [00:19:15.960] - Grace Thank you for talking with me. If people want to get in touch with you what's the best way? [00:19:20.910] - Haiko They can always send me an email at haiko@omniaretail.com. I think that's the most easy way to do this. [00:19:27.030] - Grace And then also include a link to your LinkedIn. Perfect alright. Thanks Haiko. [00:19:31.810] - Haiko Thank you so much Grace. [00:19:40.440] - Grace Thanks for listening the price points. I hope you enjoyed this episode if you'd like to get in touch with Haiko feel free to send him a message. Haiko that's H a i k o and I'm your retail dot com or connect can be linked. I'll include both of those in the show notes along with my contact details as well. In the meantime now I hope you have a great rest of your day. SHOW NOTES: Omnia was founded in 2015 with one goal in mind: to help retailers take care of their assortments and grow profitably with technology. Today, our full suite of automation tools help retailers save time on tedious work, take control of retail their assortment, and build more profitable pricing and marketing strategies. Omnia serves more than 100 leading retailers, including Decathlon, Tennis Point, Bol.com, Wehkamp, de Bijenkorf, and Feelunique. For her clients, Omnia scans and analyzes more than 500 million price points and makes more than 7 million price adjustments daily. Website • LinkedIn Music: "Little Wolf" courtesy of Wistia TO CONTACT HAIKO KRUMM: Email: haiko@omniaretail.com LinkedIn: Visit here TO CONTACT GRACE BALDWIN: Email: grace@omniaretail.com LinkedIn: Visit here

Price Points Podcast EP 6: The Power of Customer Success

13.10.2020

Price Points Podcast EP 3: Risks and Rewards in Dynamic Pricing

What are the risks and rewards of dynamic pricing, and how can you tip the scales towards reward? Travis Rice explains all in this episode of Price Points. [00:00:11.590] - Grace Hello and welcome to price points...

What are the risks and rewards of dynamic pricing, and how can you tip the scales towards reward? Travis Rice explains all in this episode of Price Points. [00:00:11.590] - Grace Hello and welcome to price points episode three. I'm your host Grace Baldwin. And today we're talking about the risks and rewards of dynamic pricing. Risk aversion falls on a spectrum. Some people are naturally more tolerant of risks but others try to avoid it like the plague. No matter where you personally fall on the spectrum though when it comes to big changes at work are warning bells start to ring. It's understandable. Tools like dynamic pricing do affect your job pretty dramatically and any big changes the way we work are enough to leave us with sweaty palms and an elevated heart rate. But is the perceived risk around dynamic pricing actually valid is dynamic pricing really that big of risk in the pursuit of this answer. I sat down with Travis Rice one of our customer success managers working with our enterprise customers to make sure they get the most out of Omnia and by conducting business reviews giving helpful tips and tricks and updates on where the product is going. Just from our chat it's pretty obvious that he understands the resistance to dynamic pricing deeply but that he will also talk us through that resistance until you feel totally comfortable with the tool. Travis and I talked at length about the fears and risks around dynamic pricing and he gave me a lot of reasons why the practice is actually less risky than you might imagine. So sit back and relax and enjoy this interview with Travis Rice. Welcome Travis. Thank you for sitting down with me. Can you tell me a little bit about yourself and what you do here. [00:01:45.800] - Travis So thanks Grace. Name's Travis. I'm a customer success manager here at Omnia. My main responsibility is to help customers achieve value through our platform to really understand what they can do strategically and commercially with Omnia for their pricing strategies. So when it comes to our team as a whole I work directly with our consulting team. I work directly with our product team and many internal facets to really help us further understand what do customers need. What can we further iterate in our product to help them again get the most value moving forward. [00:02:08.730] - Grace So today we want to talk a little bit more about fear and dynamic pricing in the risk when it comes to dynamic pricing. So what are people afraid of when they think about dynamic pricing. I mean do you think that there is a resistance to dynamic pricing and why. [00:02:31.970] - Travis Actually I do and I have seen this as a reoccurring trend especially a lot of the new customers that we've been onboarding even some of the prospects. So. I actually think it's funny I come from a world of the background of marketing and this is what marketing went through five six years ago where a lot of the tasks were being done manually. A lot of the work was being done manually especially on the agency side and there was a huge resistance to automation there there's a huge resistance to the marketing automation whether it's you know big email flows or the agency side in the performance side of saying Okay well we don't want to give our bidding over to Google right. And so at that time it wasn't necessarily more effective but today it is. So I see that very similarly here in the retail space in that I believe a lot of customers and in their executives are saying we're really a little resistant to moving towards a dynamic pricing model. We don't necessarily know how this is going to be advantageous for us or on the other side. We do know that this is something we want to move towards but we're scared in the process. We don't know how this is going to look both the change internally and the change for what our business outcome is going to be. [00:03:46.970] - Grace Why do you think people are resistant to it? Do you think there's a fear of a lack of control or a lack of oversight in it? Do you think that there's some sort of a fear within the automation itself that makes people a little nervous about it? [00:03:59.700] - Travis Yeah I mean I think people are inherently resistant to change. And I think when you have a process and whether it's the most efficient or not it's something that you're comfortable with and it's something that you know when you're changing that process it can feel like it's a little bit of a risk. Something like Omnia it's a platform right. It's not going to come in and tell you what your commercial strategy should be what your pricing rules should be. But I do think that it does force people to really understand and evaluate that themselves. You can't use Omnia if you don't understand what pricing rules you want to put in place what those pricing rules are eventually moving towards in terms of your overall commercial strategy. And so I think that a lot of again that maybe that fear of that lack of control is valid right. I think that you're right to feel that way any time you implement a new system it does change your internal workflows and it does have an impact on your bottom line. But the thing that I would also encourage people to look at is what's the opportunity if we do change to this how much better can our internal workflows be how much more depth of data is going to be available to our pricing team. What can we then get insights from in terms of okay. We know that we're moving dynamically with the market because a lot of these industries these days that you wouldn't even think tires fashion. I mean obviously electronics is an obvious one but a lot of these industries have already moved to denim and pricing. And so if you're not in your resistance to it you're not necessarily saying well I don't want to be the first one to be moving here you will your competitors are. You also need to understand that there is a lot of opportunity cost to resisting this change and giving into that fear. [[00:05:35.270] - Grace How big of a change is Omnia? [00:05:37.250] - Travis I think it can be a big change. I think it can be a big positive change too. So when you look at Omnia as a platform again it does not work if you don't have a commercial strategy laid out. If you don't have pricing rules laid out if you don't know what you want to achieve with Omnia. It's simply a tool and a tool allow companies to really transform the way that they do pricing let's say internal pricing team you're spending x amount of hours on actual execution and putting in this strategy week in and week out manually looking at prices manually making changes and think if you're able to put that number of hours in two more strategy. I think that is transformational in and of itself. When you look at the bottom lines knowing that okay the prices we're putting out there to the marketing channels that they're going towards it's going to impact the marketing department. It's going to impact pricing. It's going to impact purchasing. We have a lot of insights in reports that can be taken in by the purchasing teams. So going through and getting better negotiations from the suppliers and from the brands themselves. So I mean I think when you're looking at that whole organization there is a ton of opportunity that's available. It's just depends do you want to give in to the fear of hey this is a brand new process this is a brand new product. It's a platform I don't quite understand yet. Or do you want to say this is a great opportunity for me to learn something new and for me to make our organization competitive if not more competitive in the market [00:06:58.580] - Grace So the fears behind dynamic pricing I think that there's a lot of fear. Like when we flip the switch what happens next. And there's a fear of OK are we going to have a race to the bottom. Are we going to understand what's happening. Do these fears have any validity? [00:07:12.770] - Travis Yeah I think they do hold some validity and I do understand where they come from. You know I think the first the first thought that a lot of directors and executives have about dynamic pricing and what the impact will be is. OK. The algorithm is just going to make us the cheapest and then the competitors the cheapest and then where the cheapest and we end up having this race towards the bottom. It doesn't work that way. You know Omnia takes into account a lot of business rules. It takes into account minimum acceptable margins and there's certain fail safes that are actually in place. So I do think that there are inherently like any new system any ERP system any marketing system any financial system. There are inherent risks if we just said here's a platform. Go ahead and use it. Right but Omnia has a team of consultants. We have an onboarding team and we have a customer success team that I'm a part of that really teams up with each and every one of our customers to make sure that they understand what are the safety nets that in rules that we have to be putting in place. What are the types of data that we need to take into account. How do we ensure that we have the proper integrations. So I do. I do think if you just said more generally is there a risk to dynamic pricing maybe. How do we mitigate those risks and do oftentimes do we almost eliminate them. Yes. And so I do think that at the end of the day moving towards dynamic pricing is a very low risk high reward opportunity for many many companies. [00:08:43.460] - Grace How can companies tip that balance of risk and reward more towards reward? So we've already mentioned really understanding kind of what you're doing finding the right team. Is there anything else really that helps make this more reward than risk. [[00:08:59.720] - Travis Yeah I think the first it comes comes back to you need to be realistic about where your industry is moving towards. There is going to be opportunity cost with not moving towards dynamic pricing. If you're still doing things manually internally and changing your prices the market's likely changing if not every day multiple times a day. So I do think that that's a big aspect to take into account. But the other thing is if you want to get more reward out of this than risk again this is an opportunity to really define what sort of pricing rules do we want in place what is how does our pricing impact our overall commercial strategy and I do think that I've been surprised at some of the conversations I even I've had my time at Omnia with customers that these are the types of conversations that can go six, 12 maybe even 24 months without being re-evaluated. Are you continuing to re-evaluate your strategy. Are you continuing to look back and say do we need to tweak some of our pricing rules. Do we need to get more granular with specific brands or categories in some companies don't. Some companies are really good at that and those are the ones that are getting an advantage in the field. So the ones who are gonna get the rewards. Are we going back in and are we using Omnia for getting more granular with our pricing strategies and the reporting that we get back from the insights that we take. Are we then going back and re-evaluating as an organization or as a pricing team. Okay well now we had the first iteration how do we do better the next time how do we continue to iterate. And that's really the process that most people are going to see the most value from. [00:10:39.110] - Grace Do you think that that the fact that you're automating so much of the previous manual labor now gives you time to go over those insights and actually point a little bit better and and iterate and test and figure out what works and what doesn't. [00:10:51.320] - Travis Yeah exactly. I think that hits the nail on the head. You know us as humans we only have a certain amount of hours in our week some are willing to put more towards worker or you know more towards other things. But at the end of the day we only have a certain amount of time that we're going to be able to invest in our work. The more that we can allocate that to strategy the more that we can really move that towards collaborating with our team rather than the actual execution of work in the manual processes. And you look at that over time the aggregate of that time saving the aggregate of that time going towards areas that are going to more effectively impact the bottom line I think is really going to increase the reward people will see from using dynamic pricing especially with a tool like on how do you think people can get comfortable with dynamic pricing from the start. [00:09:45.770] - Grace So what are some of the different ways brands can differentiate their assortment across different channels? [00:11:38.750] - Grace So you know I think a lot of people maybe understand that dynamic pricing is important and maybe at the point where they know that they need to find a solution but they're still not totally comfortable with it. Do you have any advice on how to actually just feel more comfortable with the idea of dynamic pricing. [00:11:56.630] - Travis Yeah absolutely. I mean first thing it's a you know self plug here but I would recommend reaching out to Omnia. We have a team of consultants we have a team of customer success managers like myself who are always willing to go through the process. I mean I thoroughly enjoy the conversations I have where there's question question question question because that's our goal we want to make you feel comfortable with not only the transition but the process and what the ultimate outcome could look like for you. It's not for us to define what your strategy should be or could be or what rules you have to put in place that's for you to find out that's for you to really determine internally you know what is important to us as an organization where do we want our focus to be. But if you're feeling uncomfortable if you're feeling a call we don't know the first steps or here's a platform that we're not quite as comfortable. And I actually liked your question before about how do we know if we foot the switch that this isn't going to go wrong. Do you think that at the same time you look at the opportunity that's available to you you also need to be realistic in that this does impact organizations and it does impact jobs and I fully understand the hesitancy to move a process you know over to a more automated system. The great thing that on our team provides is again going through the actual tangible fail safes that are in place what sort of catch all pricing rules you should implement so that things aren't missed. And the insights that you can get from it. So we're gonna be able to then kind of coach you through that whole process. And the last thing I'll say on this is it doesn't have to be a switch that happens right away. I think just like anything else every other industry the idea is hey we're gonna get this up and implemented and all of a sudden in three months or in six months everything's changed. This is a process and it should continue to always be a process just like any other thing in business when you're rolling out a new product. You realize okay there's certain iterations we need to have or maybe we change the messaging on our go to market for this for this product. It's the same thing with your internal pricing right. So we're gonna start and maybe some companies start a little bit more conservatively and say that's OK you if you want to get used to the system you want to put in place the first few rules that are really going to start to impact it within a certain you know within a certain margin that's perfectly acceptable and then start to get more granular from there then start to iterate from there. Not to say that the simplicity almost isn't more effective sometimes it can be sometimes these really granular plans right off the bat they're just too complex to understand and our system gives a really transparent way to see what pricing rules are impacting the final price. How did it get. How did the system come to that so that your pricing team can really say okay I'm comfortable with how Omnia is contributing to it. I understand how they made the pricing changes and I agree with them. So again I think it is. I see as a process I don't see this as a switch that you know we go from before and after. And then it set it and forget it and I don't believe there is any really effective system that does do that. So I wouldn't view pricing the same way either its foundation piece in The it's all based on what it again come back to you what is your commercial strategy what are the pricing rules that you believe are gonna work best or have worked best for you. And then how do we start to automate that once you get the insights back. How do we start to iterate and get better and better and better. [00:15:12.080] - Grace How quickly can someone see value and see the reward of dynamic pricing? 00:15:17.260] - Travis Yeah it's a good question and I think it again it's going to come back to how you wanted to find value are you going to be seeing in your bottom line week one maybe maybe not. Are you going to be able to start seeing process improvements once we do turn on on year once you do start to integrate that in with your internal workflows. Yes you're going to be able to see right away how is on your making these pricing decisions. Is it changing our pricing. Is it automated through my whole process at least as far as is we want to allow to begin with. So yes from day one from a process standpoint the value is going to be instant. Now how does that value translate into the bottom line to increasing margins to increasing revenue. That's again going to be largely dependent on did we have the right pricing rules in place or do we need to re-evaluate those pricing rules to be more effective moving forward again. I wouldn't say Omnia is not something where you just set a specific target and say hey like in marketing I want to you know 3000 percent return on my ad spend Google go ahead and do this Omnia is not necessarily translated in that way again I think the value from the bottom line is going to be how effective is my commercial strategy in my realistic about where we're at in the market and what sort of pricing rules do I want to integrate into that commercial gee how effective are those. So the two pieces that I see is the internal value side. That's instant and I will continue to grow as people get more comfortable with our platform. The revenue the margin and the bottom line business side that happens over time. And I think that's just like any other system. Again I'm all about iteration. I'm all about the process but it can and I think again you look at quarter after quarter after quarter that's when things get really interesting because the little iterations and the better that we get each quarter. Now when you start to look at year over year I think that's when things can get really fun for looking at the bottom line there. [00:17:11.970] - Grace Well thank you for sitting with me. If people want to get in touch with you. What's the best way for them to contact you. [00:17:18.160] - Travis Yeah if anyone wants to reach out. My email is Travis at Omnia retail dot com. [00:17:23.130] - Grace Can people also find you on LinkedIn? [00:17:24.900] - Travis Yeah of course. [00:17:26.500] - Grace Okay cool, I'll link I'll link that in the show notes. [00:17:28.900] - Travis All right sounds good. Thank you Grace. [00:17:37.220] - Grace Thanks for listening to Price points. I hope you enjoyed the interview with Travis if you'd like to reach out to him. Feel free to email him at Travis at the retail dot com or on LinkedIn. As always I concluded his contact info in the show notes so you can easily access it if you'd like to get in touch with me. You can also send me an email at Grace at a retail dot com or on LinkedIn and you can also find that information in the show notes as well. I would love it if you reached out and told me what you think of the show, your ideas for future topics or how I can just make it better. In the meantime though I hope you have a great rest of your day. SHOW NOTES: Omnia was founded in 2015 with one goal in mind: to help retailers take care of their assortments and grow profitably with technology. Today, our full suite of automation tools help retailers save time on tedious work, take control of retail their assortment, and build more profitable pricing and marketing strategies. Omnia serves more than 100 leading retailers, including Decathlon, Tennis Point, Bol.com, Wehkamp, de Bijenkorf, and Feelunique. For her clients, Omnia scans and analyzes more than 500 million price points and makes more than 7 million price adjustments daily. Website • LinkedIn Music: "Little Wolf" courtesy of Wistia TO CONTACT TRAVIS RICE: Email: travis@omniaretail.com LinkedIn: Visit here TO CONTACT GRACE BALDWIN: Email: grace@omniaretail.com LinkedIn: Visit here

Price Points Podcast EP 3: Risks and Rewards in Dynamic Pricing

25.08.2020

What is Bundle Pricing?

When it comes to online shopping, bundle pricing is ubiquitous. This pricing method is extremely popular amongst Internet retailers, and for good reason. Competitive bundling is an excellent way for you to push more...

When it comes to online shopping, bundle pricing is ubiquitous. This pricing method is extremely popular amongst Internet retailers, and for good reason. Competitive bundling is an excellent way for you to push more product, stand out from the crowd, and connect with your audience in an intriguing way. So what are the benefits of bundling? Keep reading to learn more about this strategy. Bundle pricing definition Price bundling, also product bundle pricing, is a strategy that retailers use to sell lots of items at higher margins while providing consumers a discount at the same time. With bundle pricing, retailers offer several different products as a package deal, then offer that package to consumers at a lower price than it would cost to purchase those items separately. In the example below, which shows a Fujifilm Instax camera bundle and which sells for $99, consumers get a camera, a case, batteries, two film packs, a camera case and strap, a photo album, a self lens, colored filters, hanging frames, a clips and string to hang photos from, sticker frames, a cleaning cloth, and standing frames. That’s a lot of product, especially when you consider that the camera itself costs somewhere in the realm of $60. Bundle pricing is a great way to move products quickly, sell off less-successful SKUs, and offer more value to your loyal customers. Bundling is extremely common in e-commerce and retail, and you’ll often see product bundles on cheap goods or discount items. However, it isn’t the only application for price bundling, and companies in all sectors from software to utilities (like Comcast) use bundles to sell their products. Bundling works because price is the most important “p” in the marketing mix. Price is often the most important differentiator for consumers, and when they can get a bundle price on products they love, they will feel like they’ve gotten the best deal possible. Product bundle pricing has advantages and disadvantages. On the one hand it’s a great tactic to use if you want to move product quickly or give your customers a great value. However, product bundling pricing may weaken your brand if done incorrectly. It’s ultimately up to you to build a great strategy that delivers value without hurting your image. Set up your pricing strategies with ease in Omnia's Pricing Platform Request a free demo What is an example of bundling? Bundles are everywhere in retail and e-commerce. They are most common in discount stores or amongst cheap goods, but luxury brands may also run promotional bundles on occasion. However, bundles are especially important to Amazon’s strategy, and the online marketplace makes great use of bundles (which you can learn about in our guide to selling on Amazon). There are countless Amazon bundle examples, so it’s easy to dive in and look at what works. In general, there are two types of bundles on Amazon. The first is a Seller-created bundle, like the one in the photo below. This bundle is built around one high runner — the Nikon camera — which is then sold with 22 other “accessory” items like camera straps, memory cards, lenses, tripods, flash devices, and more. It’s the perfect kit for someone who enjoys photography enough that they’re willing to invest in equipment, but who doesn’t already have everything a professional may want. An Amazon bundle example built around one major high-runner item: a Nikon camera. The key to this bundle is that it is a great deal for consumers. It would take countless hours to find all of these items separately, and it would likely be more expensive to purchase each accessory individually. With this bundle, which costs $619, a consumer can be ready with their complete camera kit within two days. It’s the kind of bundle that will leave an amateur photographer with sweaty palms and a thumping heart as they click “Add to Cart”. The second type of product bundling strategy on Amazon is the kind suggested by the marketplace itself. In the image below you see an Amazon listing for a Magic Bullet blender, which costs $38. In the bottom left hand corner of the image though, you’ll see a section on the page titled “Frequently bought together” which suggests two additional products to the consumer. This section is the Amazon-suggested bundle, which uses Amazon’s algorithm to determine similar products and suggest them in the same post. In one click, the shopper can easily add all three items to their cart and know they’re getting everything they could possibly need for this blender. This suggested bundling isn’t only for small electronics. In the screenshot below of a listing of a MacBook computer you can see that Amazon suggests a pink laptop protector and case as an additional item. Related: How the Coronavirus will Affect Retail Bundles are popular outside of Amazon as well. The below bundle is a great bundle pricing strategy example. It is from the company Alpkit, which makes outdoor gear in the United Kingdom. This bundle is built around the idea of a “mountain marathon”, which is, as you may have guessed, a marathon that takes place on mountain trails. An example of a bundle in the outdoor clothing category. This bundle includes two coats, gloves, socks, a shirt, and waterproof running pants. Mountain marathons require special technical gear because weather conditions can change so quickly out in the wild. Many races require that you bring things like gloves, jackets, and trousers with you as you run, but this technical gear is often extremely expensive. Some runners will acquire these pieces over time, but some of the individual pieces can create a significant hurdle to investment (like the rain jacket in the above bundle, which costs €120). Alpkit solved this problem with a smart bundle that includes much of the gear you would need for a trail race. This kit not only moves products out of Alpkit’s warehouses — it also saves the consumer €98. How to create and use price bundles To create effective price bundles, you need to get into the mind of the consumer. What are they really looking for, and how can you give them more value with a bundle? So what can we learn about bundling from Alpkit and the other examples we’ve seen in this article? A couple of things: Understand what your users are looking for, whether that is a camera or mountain running clothes Use a high-runner item as a centerpiece Fill in the gaps with simple accessories Product popularity data (which you can get with Pricewatch) is a great resource for creating effective bundle packages because you can understand which products are flying off the shelves and which products are taking up space. If the slow-moving products complement the fast-moving ones, you can pair the two together to create a bundle that helps clear out your warehouses. This is an especially popular strategy with electronics like TVs and laptops, which will often come in bundles with charging cables, HDMI cords, and other items. You can also create bundles of popular products, which can make your high-runners even more attractive. If you see that the most popular products in the market could combine well together, you could create a “sale” bundle of these high-ticket items and sell it at a slightly higher price than you could if you discounted each product individually. You can still discount these products individually to drive people to your store with dynamic pricing (especially if they are highly elastic products), but offering the products together gives you some room to improve your margins. Finally, you can use bundles to give consumers more control. If you follow a “build your own package” model, you can give consumers the chance to create their own bundles from a selected assortment of products, then layer a discount percentage on top of their final choice. Final thoughts Bundle pricing is an awesome way to get creative with your assortment and delight consumers in unexpected ways. If you can create a bundle that meets your audience’s needs and satisfies your business goals, you’ll find a happy medium that pushes products off the shelf while keeping your store profitable. Curious to learn about some other pricing strategies? Check out some of our other articles below. What is Charm Pricing?: A short introduction to a fun pricing method What is Penetration Pricing?: A guide on how to get noticed when first entering a new market What is Cost Plus Pricing?: In this article, we’ll cover cost-plus pricing and show you when it makes sense to use this strategy. What is Price Skimming?: Learn how price skimming can help you facilitate a higher return on early investments. Here’s What You Need to Know About Psychological Pricing (Plus 3 Strategies to Help You Succeed): Modern day pricing is so much more than a numbers game. When thought about correctly, it’s a powerful way to build your brand and drive more profits. How to Build a Pricing Strategy: A complete guide on how to build a pricing strategy from Omnia partner Johan Maessen, owner of Commercieel Verbeteren.

What is Bundle Pricing?

13.08.2020

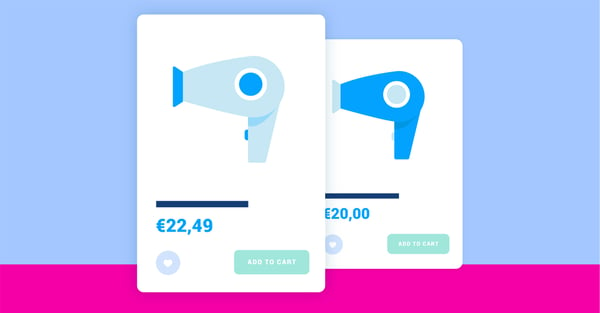

What is Cost Plus Pricing?

When you produce a product, it costs your company a certain amount of money. When it comes to pricing, this “cost” serves as an anchor point for most pricing strategies. Because it costs money to produce a product,...

When you produce a product, it costs your company a certain amount of money. When it comes to pricing, this “cost” serves as an anchor point for most pricing strategies. Because it costs money to produce a product, retailers and brands, understandably, want to have an end price that is more than that cost. If the end purchase price is lower than it costs to produce a product, the retailer or brand will lose money every time they sell that product. This is where cost-oriented pricing comes into play, most notably a cost plus pricing strategy. In this article, we’ll cover cost-plus pricing and show you when it makes sense to use this strategy. What is cost plus pricing? Cost plus pricing is the most straightforward pricing strategy out there. Sometimes called a variable cost pricing strategy, variable cost pricing model, or even full cost pricing, this price method guarantees that you never lose money in a sale. Cost based pricing is the foundation for any smart pricing strategy, and is both easy to calculate and apply to your assortment. There are only three steps involved in the cost plus pricing formula: determine how much it costs to produce a product, determine how much margin you want to make (also called the “markup,” meaning how much you mark the price up above the costs), then calculate the final price by combining these two figures. “Markup” another word for the amount that you add onto the cost of a product in order to achieve your desired margin. Markups are expressed in percentages and currency amounts. How to calculate markup percentages Markup percentage is the percent amount that you add to the price for markup. To calculate a markup percentage, there is a markup percentage formula. All you need to do is subtract the cost of the product from the end price. Divide that number by the cost of the product, and multiply the result by 100 to find the markup percentage. The retail markup calculation, also called markup pricing formula Talk to one of our consultants about dynamic pricing. Contact us Pros and cons of a cost plus pricing strategy The biggest pro of a cost plus pricing strategy is that it’s simple: just calculate your costs per unit, decide how much margin you want to make and calculate a price based on this information. But this simplicity means that cost plus has a few major disadvantages in the world of variable pricing. To start, it only considers internal variables in calculating a price, but doesn’t account for larger market influences in the pricing equation. Imagine you are selling a hair dryer, which costs you €10 to make. Say you want to make a 50% margin, in which case you’d add a €5 markup to the item on the market. This is a great strategy, and you’re guaranteed to always make that €5 with every sale. But if you looked at other products on the market, you may discover that you can raise that price a little more. Below are the first two results that appear when searching for a hair dryer. The first is from Philips and is listed at €22.49 at MediaMarkt. The second is from Hema, and is listed at €20. Even if you want to be the lowest price out of these three hair dryers, you’re still missing out on margin by only pricing yourself at €15. Related: Price: The Most Important P in the Marketing Mix The second major disadvantage to cost-plus pricing is that it isn’t flexible enough to keep up with the current dynamic market (especially if you are selling on Amazon or other fast-paced market places). If you only use cost-plus, your prices will never change with market dynamics. So, if the two hair dryers in the above example drop price unexpectedly, you may accidentally end up as the highest-priced option on the market, which can damage your price perception and lead to a reduced number of sales. Cost plus pricing also makes digital investments in things like electronic shelf labels, dynamic pricing, and pricing data like Pricewatch useless. Finally, a cost plus pricing strategy doesn’t account for the times where you may WANT to sell items at a loss. Some examples of these kinds of strategies include end-of-season sales, clearance sales, Black Friday sales, penetration pricing strategies, or even times when global pandemic fundamentally alters retail. Related: How the Coronavirus will Affect Retail What to think about when using a cost plus pricing strategy When you consider the cons of a cost plus pricing strategy, it’s easy to see why we at Omnia don’t advise cost-plus as the only strategy you use. Determining markup varies from retailer to retailer and category to category. There’s no standard markup pricing, and there isn’t any sort of markup pricing “formula” that can fit every retailer’s needs. Instead, retailers and brands need to think about markup within the context of their market. There are two main considerations: stock rotation and strategic positioning. Stock rotation Let’s start with stock rotation. If you are in an industry that has fast stock rotation, you can get away with having lower margins on the products you sell. This is because you’ll sell a high volume of these products, meaning you’ll still make profit even if there isn’t a high margin. If you produce or sell a slow moving product though, you’ll need to think about your markup differently: because you won’t sell a high volume of products (and because your products will take up valuable shelf or warehouse space for longer periods of time), you need to recoup the loss with a high margin. This is why luxury goods — like a timeless Rolex — come with high prices. You’ll have to think about where your products sit on this spectrum when determining your markup. Strategic positioning Beyond thinking about stock rotation though, you also have to think about the product’s strategic positioning. In some cases, you may want to sell a product at a LOSS instead of a gain, in which case the cost-plus pricing strategy may not be relevant for you. “Diapers are a great example of this strategic loss,” says Sander Roose, CEO of Omnia. “It’s well known within retail that diapers are not a profitable product. But smart retailers use this knowledge strategically. In many cases, they may run a sort of high runner strategy and sell the diapers at a loss, but with the ultimate goal of pulling families into the online shop. These families have bigger budgets, so retailers can easily make up for the loss on the diaper with other products.” When to use a cost-plus pricing strategy “I think a cost-plus pricing strategy makes sense for non-comparable products or own-brand products,” comments Sander. “If you can’t compare your product to anything in the market, or don’t have price elasticity data, then you can use cost plus to arrive at sensible prices for your products.” A cost plus strategy may also be good as a fallback strategy or a “last resort” pricing strategy within your dynamic pricing engine. Cost oriented pricing can be an effective way to figure out the pricing floor for your dynamic pricing strategy. When you account for a certain amount of margin as your lowest price, you can still ensure that all sales will be profitable. Final thoughts The cost plus model pricing is easy to apply to your assortment, but it does have a few major disadvantages. That said, it’s a great starting point that you should use as your price floor in any dynamic pricing strategy you create. Curious about other pricing strategies? Check out our series of different strategies, all linked below. What is Value Based Pricing?: A full overview of how price and consumer perception work together. What is Charm Pricing?: A short introduction to a fun pricing method What is Penetration Pricing?: A guide on how to get noticed when first entering a new market What is Odd Even Pricing?: An explanation of the psychology behind different numbers in a price. Here’s What You Need to Know About Psychological Pricing (Plus 3 Strategies to Help You Succeed): Modern day pricing is so much more than a numbers game. When thought about correctly, it’s a powerful way to build your brand and drive more profits. How to Build a Pricing Strategy: A complete guide on how to build a pricing strategy from Omnia partner Johan Maessen, owner of Commercieel Verbeteren.

What is Cost Plus Pricing?

07.08.2020

Here’s What You Need to Know About Psychological Pricing (Plus 3 Strategies to Help You Succeed)

Modern day pricing is so much more than a numbers game. When thought about correctly, it’s a powerful way to build your brand and drive more profits. But how do you access the full power of pricing? The key is to...

Modern day pricing is so much more than a numbers game. When thought about correctly, it’s a powerful way to build your brand and drive more profits. But how do you access the full power of pricing? The key is to understand the psychology that goes into a pricing strategy, and this article is a perfect place to start. To continue our series of articles about different pricing strategies, in this article we’ll discuss what psychological pricing is, how it works, and what you need to build a great psychological pricing strategy. What is psychological pricing? Psychological pricing is the practice of using the power of psychology to push consumers to spend. It’s a joint effort of pricing, marketing, and sales to build an attractive offer that captures consumer attention and makes a product so desirable the shopper can’t wait another day to buy it. Psychological pricing techniques are nothing new, and clever vendors have used these strategies throughout history to influence consumer behavior for quite some time. Before price tags, store clerks had to learn the art of haggling to create deals that were mutually beneficial for customers and the store, and since price tags emerged, marketers have leveraged the power of price to achieve the same results. However, just because psychological pricing strategies are ubiquitous doesn’t mean they are unimportant. In fact, they’re so important and foundational to pricing, marketing, and sales that you should have a deep understanding of how these strategies work. Why does psychological pricing work? To understand why psychological pricing works, we need a quick lesson in marketing and pricing psychology. Take a look at Maslow’s hierarchy of needs, which is a theory of how humans prioritize different things in their lives. At the bottom of the pyramid are physiological needs — you know, the things we as humans truly need for continued survival. These include food, water, shelter, rest, oxygen...et cetera. Above the physiological needs are safety needs. In other words, once you have the basics of survival covered, humans become more concerned about their general safety and security. After worrying about safety and security, the theory states that humans care about belonging and community. We want to build friendships, experience love, and the “gezelligheid” that comes from being around other people. After community, people begin caring more about themselves and their aspirations. The next tier above belonging is “Esteem” and the very last tier (the one at the tip of the pyramid) is “Self-Actualization.” Chances are you know all of this already, especially if you work in e-commerce marketing. Maslow’s hierarchy is a foundational element of modern marketing theory...so why am I bringing it up? When you, your pricing team, sales team, and marketing teams want to create a psychological pricing strategy, you should refer back to Maslow’s hierarchy to serve as guidance for the strategy. As you’ll see shortly, this framework gives you the freedom to be creative in your strategy, while also making sure it is effective. Related: Price: The Most Important P in the Marketing Mix So the answer to why psychological pricing works is because these strategies are based on a deep understanding of what drives people, not just customers. To even get started, marketing teams, pricing teams, and sales teams need to have a deep understanding of what drives people, not just customers. Related: How Will the Coronavirus Affect Retail? Examples of psychological pricing strategies Psychological pricing strategies are everywhere, and are employed by some of the top global companies like Amazon, Hershey, Motorola, Apple, and Costco. In this section we’ll highlight a few examples of psychological pricing tactics, many of which we’ve already written about extensively on Omnia’s site. 1. Value based pricing Value based pricing is a “basic” pricing strategy, but it’s one of the hardest to pull together because it requires an excellent understanding of the market and a lot of self-reflection. In a value based pricing strategy, you use your price as a way to control consumer understanding of your product. Do you want to be seen as a luxury brand? Then you probably should have a luxury price. Do you want to come off as the best value-for-money option on the market? Well, your price should reflect that. Value based pricing requires a lot of research into your target market, competitive landscape, and business goals. That means a lot of cooperation across departments, but that cooperation is a great way to build a more cohesive strategy. Learn more about value based pricing in this article: What is a Value Based Pricing Strategy? 2. Odd even pricing Odd even pricing is a psychological pricing tactic that uses the power of number psychology to drive consumers to action. The odds and the evens refer to the numbers in a price: “odd” retail prices feature mostly odd numbers (like €7.99), whereas “even” prices feature mostly even numbers (like €8.00). Most often we see prices that end in odd numbers, but even prices have their own power. Odd even pricing can be used strategically in several different ways, whether it’s to offer strategic discounts or just create a price that is memorable. Below is an example of how Uniqlo does exactly that — the company is discounting a shirt that originally cost €24.90 (a mostly “even” price) down to €7.90 (a more “odd” price). We wrote an entire 1,000-word article that goes deeper into odd even pricing so we won’t go into too much detail, but check out: How Odd Even Pricing Helps You Utilize the Power of Psychology. 3. Charm pricing Charm pricing is very similar to odd-even pricing. In a charm pricing strategy, companies use prices as a way to elicit an emotional response in consumers and drive them to action. Some of the most notable examples of charm pricing can be seen in late-night infomercials. These pricing strategies are notable for their specificity, exceptional bundling strategies, and, often, their delivery. Learn more about charm pricing in our article: What is Charm Pricing? Psychological pricing is everywhere If you pay attention, you’ll see examples of psychological pricing in marketing everywhere. Once you start looking, these examples are impossible to ignore. Browse through sports stores, look at real estate listings, even check the barcode on the books on your shelf. Even alcohol companies and gas stations employ charm pricing or odd even pricing to pull in more customers. Psychological pricing advantages and disadvantages Psychological pricing strategies are extremely advantageous, but are also hard to set up. Here are a few of the pros and cons for these techniques. Advantages of psychological pricing Get a better understanding of the playing field: When you aim to use a psychological pricing strategy, you need to do a lot of research into who your competitors are, what strategies they are using, and what your target audience thinks of those pricing strategies. This research gives you tons of insights that you can use across the organization. More organizational alignment: A psychological pricing strategy should never be carried out by an isolated pricing team. Instead, these strategies require serious cross-department commitments and communications. More strategic: With a psychological pricing strategy, you can actually be proactive in your strategy. Rather than just trying to maximize profits or break even, you can consider things like public perception of your products, competitor comparisons, and more. Disadvantages of psychological pricing Complex: Psychological pricing strategies are complex. They require a lot of cross-organizational cooperation and insights. This makes them hard to set up and stick to. Time consuming: Because psychological pricing strategies require in-depth research, they can be time consuming to set up. If you invest in software (like Pricewatch or Dynamic Pricing) the job becomes easier, but it still takes a lot of energy. Final thoughts The term “psychological pricing” can cover any number of pricing strategies, several of which we’ve covered in this article. But there are no limits — in all honesty, any pricing strategy that uses consumer ideas about product value is inherently psychological, so feel free to be creative. What is most important though is internal alignment. Psychological pricing strategies work best when they align with marketing and sales to ensure a cohesive experience for the user across your webshop.

Here’s What You Need to Know About Psychological Pricing (Plus 3 Strategies to Help You Succeed)

30.07.2020

Meet the Team: Niels Botman

Whether car camping in Namibia, speeding around Medemblik, or in his work at Omnia, Niels Botman, our Product Business Analyst, has a keen sense of adventure. In this month’s “Meet the Team,” you’ll get the chance to...

Whether car camping in Namibia, speeding around Medemblik, or in his work at Omnia, Niels Botman, our Product Business Analyst, has a keen sense of adventure. In this month’s “Meet the Team,” you’ll get the chance to learn more about Niels and how he helps make sure Omnia’s product is constantly improving. Hi Niels, how are you doing? I’m fine, thanks. Great. So to start, can you give a bit of background on yourself? Yeah, so I came to Omnia three years ago. I did my studies in Marketing, and after I finished that up I went to work for one of the supermarket chains in the Netherlands, in the head office. I was there for a few years, and had the chance to work in several different commercial departments. I worked on the supermarket template, and how they build the formula of a supermarket, the merchandise, the assortment, all those things. I also did some category management in the same company, which was interesting. However, after a while I decided I wanted to do something a bit more innovative. Supermarkets are quite conservative in what they do and in how new initiatives are introduced. And just in how things get done. But I wanted to be somewhere a bit more innovative. So I ended up joining Omnia as a Product Specialist a few years ago. And what’s your role now? I am a Product Business Analyst. I work within the Product team and, together with Berend, our Product Manager, I’m responsible for everything around the product and how we can improve it. And this role is recent for you, right? Yeah it is! In 2019 I actually resigned from the Product Specialist job so I could travel the world with my girlfriend for six months, which had been a dream of ours for years. When I got back to the Netherlands, I got back in touch with Sander and Haiko and they told me there was a nice role within the Product team that was open. It was a good fit for what I wanted to do — something more technical and innovative — so I rejoined Omnia. Where did you go on your trip? We started in Tanzania with my family, then myself and my girlfriend continued on to South Africa and Namibia, which was really cool. After that we went to Asia, then finally ended in Australia where we spent a month, I think. Did you have the whole thing planned beforehand? Nope, not really. We had the first couple of stops planned, but after that we just went with the flow of things. And how do you like your role now? I love it. I think the Product Specialist role was great for me in the beginning because I had no tech or software experience. I also learned a ton on the retail side and how our users interact with the product. I really learned the product inside and out and it paved the way to where I am now. So what does your day look like? Most days I start my days with a “daily startup” where I check in and make sure that everything is running properly. After that though, every day is different, so it’s hard to describe a “typical” day. It really depends on the projects we’re working on at the moment. I think that’s a common thread at Omnia. Definitely, but that’s also what makes it fun. For me at least. I like that there is a lot of variety and freedom to pursue opportunities and initiatives and that things are always changing. There’s tons of room for improvement and growth, so we’re always wondering what we can be doing better. I really like that part of the job. What’s your favorite part of working at Omnia? Well, what I just said is definitely a big part of it. I like that there’s lots of change all the time, both on the product side and the process side. I also really like the freedom at Omnia. I like that I don’t need to ask anyone for time off if I need to go to a doctor’s appointment. I think we all work very hard, but we have the flexibility to go to an appointment and come back and finish up a little later, if need be. Also, my colleagues are pretty cool. It’s a really international bunch. On the Development side of things we have people from four different continents on the team, which is awesome. Okay Niels, last question. What do you do for fun outside of work? Well, it’s a bit of a weird time to be asking that question since we’re in a pandemic and our movements are somewhat confined. But since the start of the pandemic I’ve gotten into cycling more, which is really fun! I’ve gotten pretty into it...I’m currently riding about 100 kilometers a week.

Meet the Team: Niels Botman

29.07.2020

What 3 Months of Amazon NL can Teach Us About Dutch E-Commerce

In the beginning of 2020, we at Omnia believed the news story of the year would be the arrival of Amazon NL. We couldn’t have been more wrong about the biggest story of the year, but that doesn’t mean that Amazon NL...